How to Understand SAP and Oracle Versus AWS and Google Cloud Pricing

Executive Summary

- SAP and Oracle have very different pricing than AWS and Google Cloud.

- This article covers how this pricing is so different and what it means.

Video Introduction: How to Understand SAP and Oracle Versus AWS and Google Cloud Pricing

Text Introduction (Skip if You Watched the Video)

AWS and Google Cloud offer good pricing transparency and the ability even to adjust consumption to adjust the resulting cost. SAP and Oracle differ significantly from this with very complicated and secretive pricing and licensing. This pricing and licensing are so complicated, and it is impossible to be in conformance with all of the licensing rules. You will learn about the most important distinctions between these cloud service providers’ pricing and SAP and Oracle.

Our References for This Article

If you want to see our references for this article and other related Brightwork articles, see this link.

Notice of Lack of Financial Bias: We have no financial ties to SAP or any other entity mentioned in this article.

- This is published by a research entity, not some lowbrow entity that is part of the SAP ecosystem.

- Second, no one paid for this article to be written, and it is not pretending to inform you while being rigged to sell you software or consulting services. Unlike nearly every other article you will find from Google on this topic, it has had no input from any company's marketing or sales department. As you are reading this article, consider how rare this is. The vast majority of information on the Internet on SAP is provided by SAP, which is filled with false claims and sleazy consulting companies and SAP consultants who will tell any lie for personal benefit. Furthermore, SAP pays off all IT analysts -- who have the same concern for accuracy as SAP. Not one of these entities will disclose their pro-SAP financial bias to their readers.

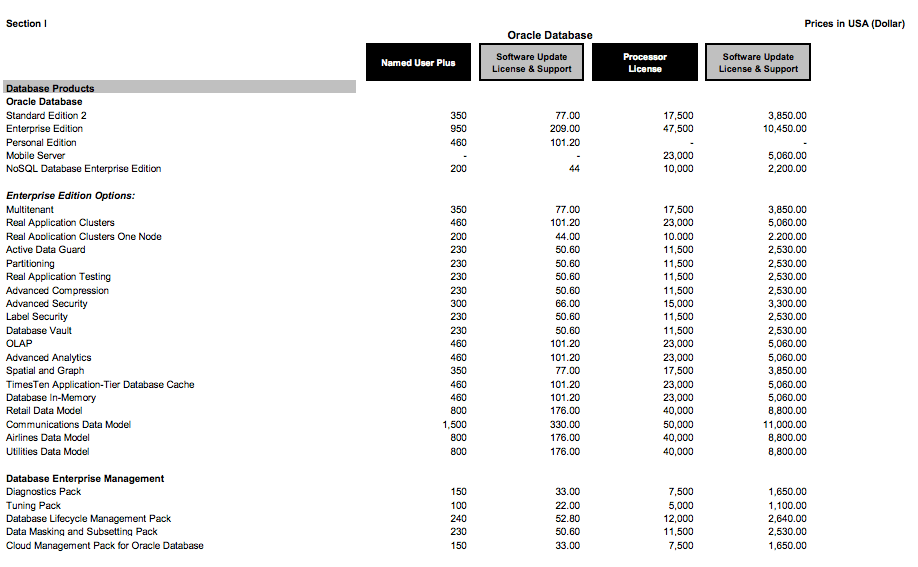

Oracle’s Price List

Unlike SAP, Oracle’s price list is “published,” but it’s both very complicated to calculate and does not include discounts. Even if the calculation is performed from the price list, that does not tell you the price a company will pay. Rounds of negotiation on Oracle pricing include Oracle pricing resources because the pricing is too complicated for the sales rep to calculate on their own. Pricing is estimated in both AWS and Google Cloud before the service is activated. As the changes are made to the service, the prices are updated. This is leveraging the web and online calculations to make pricing easier. Oracle decides to keep its pricing in a complicated format to calculate. Even if calculated correctly, the actual price can never be known without contacting a sales rep from Oracle.

And there is an excellent reason for all of this pricing opacity, as the following quotation attests.

“The main benefit of NoSQL is they are usually open source and either completely free, or relatively low cost since some support is usually purchased. Most people don’t realize how expensive Oracle and DB2 are, often costing a license fee of $1 million per server, plus $200,000 per year for ongoing support after that. Most enterprise applications need more than one server for fault tolerance, staging, QA, testing, development, etc (although licensing costs for non-production installations are often less than the production server).” – From Mark A commenting on the article The Death of the Commercial Database Oracle’s Dilemma.

This tells anyone quite a bit about the emphasis these various entities place upon pricing transparency. Also, there are many odd things with Oracle. Unlike SAP, Oracle’s price list is “published,” but it’s both very complicated to calculate and does not include discounts. Even if the calculation is performed from the price list, that does not tell you the price a company will pay. Rounds of negotiation on Oracle pricing include Oracle pricing resources because the pricing is too complicated for the sales rep to calculate on their own.

How Transparent is AWS and Google Cloud Pricing?

As can be seen in many screenshots in this books, pricing is estimated in both AWS and Google Cloud before the service is activated. As the changes are made to the service, the prices are updated. This is leveraging the web and online calculations to make pricing easier. Oracle decides to keep its pricing in a complicated format to calculate, and Oracle is continuously trying to get the most sales dollars out of their customers. There is no sales culture of selling customers what they need. This is covered in the following quotation.

“With Oracle, a significant determinant of total cost of ownership is the choice of software edition and the various options and packs selected. Oracle sales will often push Enterprise Edition without any analysis of actual requirements. Prior to SE2…customers can actually run enterprise-class workloads with Standard Edition.”

While we have distinguished SAP and Oracle versus AWS and Google Cloud, we would be remiss if we did not point out that AWS and Google’s pricing is not identically clear. Most users consider Google to have more understandable and traceable pricing than AWS. The overall pricing model of Google Cloud is more straightforward. But this is in good part also because AWS releases so many services when compared to Google Cloud.

Why The Price Paid for Oracle is Often Unknowable

Something left out of the analysis is whether SAP or Oracle’s actual overall costs knowable by customers. Oracle will often carry on about something they have that is better than an open source alternative. However, what is left out is that the open source database alternative does not come with Oracle’s sales and licensing rules. However, since when is anything discussed without consideration for the cost? Let us take the example of an automobile. No doubt, the Lamborghini Countach is a fine automobile. How many people reading this book own one?

Oracle would like cost and liability, the cost of dealing with Oracle and Oracle audits, and the restrictions with what companies can do with Oracle licenses to not be part of the discussion. SAP similarly does not want to discuss the indirect access liabilities that come with their HANA database. Yet, no other database comes with this level of liability.

What is not to like about the Countach? Are we going to talk about the price at some point? What does an oil change run on a Countach? Just the oil is $80 per quart. Furthermore, it uses 18 quarts, making for a $1,440 price oil change – but that is just for the oil. Labor is extra.

People who think the Countach is expensive will need to get ready for a shock when preparing to pay the bill for Oracle’s database; add on the costs of the time spent negotiating with Oracle, reading circuitous Oracle contracts, hardening the database against audits, in addition to the overhead of maintaining an Oracle database. By comparison, the Countach is an absolute bargain. Furthermore, the comparison is entirely appropriate as many other sports cars can do most of what the Countach can do, but with far less overhead.

With Oracle’s highly complex terms and conditions, what often looks like one price at one point, becomes a different price down the road. For example, the enterprise edition version of the database can quickly become prohibitively expensive. Oracle does something strange in that it prices its database by the number of processors or cores. There the number of cores (processors) contracted variants on discounts for scale. Virtual machines’ implications also impact the pricing, which we will be discussing shortly.

On Premises Pricing Problems

On premises, the software lacks pricing transparency, but AWS and Google Cloud bring high levels of pricing transparency.

AWS and Google Cloud on Pricing Transparency

SAP and Oracle’s focus on continually increasing costs is the opposite of what is found when using AWS or Google Cloud when costs are far more transparent. The overall costs are considerably lower. This is combined with the ability to close down services that are not used, significantly reducing the overhang of previous applications that did not work out. The issue that so consumes financial resources on SAP and Oracle customers.

SAP or Oracle offers a wide variety of discounts, with higher discounts, provided the more a customer purchases. However, these byzantine and arbitrary discounts (and which makes Oracle so tricky to price) only impact the initial purchase price; it does nothing to change the rest of the TCO of the products purchased. The discussion on SAP and Oracle negotiations is centered around how the sales rep can reduce the initial cost if the customer buys more.

For example, if we take support, at one time, both SAP and Oracle charged 15% per year for support. Then Oracle increased its support cost to 20%, and SAP quickly followed suit to match them. Currently, SAP and Oracle customers pay 22%+ support. And this is for the support that is primarily outsourced to third world countries. Oracle performs more audits of its customers than any other vendor, and SAP uses indirect access to bring multi-million dollar claims against (some of) its customers.

SAP and Oracle’s Costs of Providing Support

All of this happened as both SAP and Oracle’s costs for providing that support declined significantly as both vendors migrated support from developed countries to India, and both companies report in their financial statements that support revenue is between an 85% and 93% margin business. All of the increases in support occurred while SAP and Oracle’s support costs decreased quite significantly. This support profit margin is so high that we looked for other areas where profit margins were similarly high. We found one, which Brightwork Research & Analysis chronicled in the article How do SAP and Oracle’s Support Profit Margins Compare to Pablo Escobar. One might ask the question, why do Oracle and SAP have support margins that are so similar to a business which trafficked cocaine? Oracle and SAP prefer to spend on acquisitions rather than shoring up (and reducing their customers’ costs) of their support.

What is odd about SAP and Oracle’s continually escalating consumption of the IT budget is that IT is supposed to become more efficient with more significant investments. However, the scale returns from SAP and Oracle are not there. SAP and Oracle ceaselessly promise new products that will reduce TCO, a promise that is never fulfilled. Moreover, this is not exclusive to SAP and Oracle. It is also, at least in part, a function of the job shop or one-off nature of on-premises software. For an on-premises enterprise software purchase, the license costs are, on average, only 10% of the overall TCO of the application. Most of the costs end up being long-term maintenance.

Unhidden Costs

Cloud service providers vendors like AWS provide a managed service, which means that the costs are not hidden as they are with on-premises. It means that while not all the costs are fully allocated to the AWS bill, a far higher percentage of them are allocated to the AWS bill.

Seeking Alpha provides a good synopsis of what drives companies to AWS and, by extension Google Cloud.

“I think it is probably important to understand why customers choose AWS and why they choose cloud services at all. I will expand on this a bit but simply put, AWS is simply cheaper, simpler and more reliable than any other way most users can get the same amount of computing.

Cheaper, simpler and more reliable works for almost everyone. The current Gartner Magic Quadrant report shows AWS with one of the largest leads that I have ever seen in that series. The No. 2 in the report MSFT is said to have almost the same completeness of vision but far less executing competence.”

AWS describes its pricing this way:

“AWS offers on-demand, pay-as-you-go, and reservation-based payment models, enabling you to obtain the best return on your investment for each specific use case. AWS services do not have complex dependencies or licensing requirements, so you can get exactly what you need to build innovative, cost effective solutions using the latest technology.

“AWS services are priced independently and transparently, so you can choose and pay for exactly what you need and no more. No minimum commitments or long-term contracts are required unless you choose to save money through a reservation model. By paying for services on an as-needed basis, you can redirect your focus to innovation and invention, reducing procurement complexity and enabling your business to be fully elastic.” – AWS Pricing

We usually don’t simply provide a quotation from a provider without commenting or correcting the quotation. However, in this case, it is difficult to take issue with anything in this AWS quotation.

Secondly, AWS offers all of these things but is growing rapidly in functionality. This is known by anyone who works with AWS, but Seeking Alpha also points it out.

“Amazon says it added no fewer than 516 features to AWS last year. I have no idea what all these features are and even if I did I doubt that it would materially advance my evaluation of the forward momentum of AWS.

But the point is that AWS market share lead means that it can amortize development costs over a significantly large base of revenues making more attractive and affordable for the company to add features.”

The point is that no one, not even those that work at AWS, can keep up with even a fraction of the services and services tweaks that AWS introduces.

AWS and Google intentionally lower prices to lure customers to their platform. That’s is one way they sustain 49% growth year over year. AWS and Google could charge more. Instead, they purposefully cut prices every year (more often than that, we typically get price cuts every month). They can do this because, at their scale, the large discounts they get on hardware. Companies like Oracle, on the other hand, are accustomed to far higher margins. This margin is the problem for Oracle and the opportunity for the likes of AWS and Google. Oracle can’t compete on price and scale to even 25% of the cloud’s total revenue.