How to Understand SAP’s Fictional Cloud Revenues

Executive Summary

- SAP presents fictitious cloud revenues that are blindly accepted by Wall Steet.

- Wall Street shows close to zero interest in understanding SAP’s cloud revenues.

Introduction

SAP released the following explanation for a recent layoff.

See our references for this article and related articles at this link.

“Yet key indicators showed signs of weakness in the fourth quarter, with growth in new cloud bookings slowing to 23 percent from 37 percent in the third quarter.

Underlying non-IFRS operating margins, at constant currency, were squeezed by 1.5 percentage points in the quarter to 33.2 percent as SAP implemented hyperinflation accounting for crisis-hit markets in Latin America such as Venezuela.

Mucic noted that margins were stable at 28.8 percent for 2018 as a whole following years of declines as the company invested in its transformation. “Now we are at the point where we can start to see rising margins,” he told a news conference.”

Repeating Fiction

Something none of the analysts mention is that SAP’s cloud revenues are pure fiction. I find analysts strange. They report or comment on numbers as if they are real. Financial analyst firms hire from the most prestigious universities, yet its increasing evidence that they don’t bring anything to the table except repeat things said by companies. Companies that have a massive incentive due to stock options to misinform analysts (who can then go and mislead investors).

It is a bit like people talking specifics about unicorns (did you know they only come out on Thursdays, and they have a golden hue when the light hits them a certain way? Did you know they enjoy eating at Burger King?). SAP does not get significant revenues from cloud acquisitions (although they pay a big multiple for every purchase).

SAP’s Cloud Markup Layer

SAP Cloud is just a markup layer on AWS/GCP, which we covered in the article How to Understand SAP’s Upcharge as a Service Cloud, SAP HEC is markup machine on private cloud/hosting. SAP’s cloud revenues growth are coming from charging cloud services by using their account control. It is quite disgusting. It is a welfare queen’s strategy. Let someone else do the work, let them produce new services, make the investments. Then put a layer on top of their stuff and pretend you are a cloud provider. This is how Oracle also operates; it is called “cloud through PowerPoint.” While these companies are the cloud in their marketing literature, they are on-premises in their software. That is SAP, and Oracle’s hybrid cloud strategy is PowerPoint Cloud/On-Premises.

SAP could come with a marketing campaign…

“Through our upcharge layer, you can access all of the innovation that you could also access just by going directly to the cloud service provider.”

Oh, and it is worse than that because if you spin up SAP through SAP Cloud, you get stuck with SAP’s cloud knowledge and configuration.

The analysts, utterly unaware of any of this sit there saying

“SAP said ABC so XYZ.”

And that ladies and gentlemen are how you make an excellent paycheck. Learn to repeat and copy statements from companies. However, it is unclear if the term “analyst” should continue to be applied. When information is not analyzed but just repeated, usually the term that is used is a copy device or a stenographer. Some might also call it a “parrot.” The parrot can make precise vocal intonations but does not know what they are saying.

Cloud growth! Cloud growth……wayyyyyyyyeee!

How Accurate Are SAP’s Claims Around SAP Cloud?

Observe how SAP tries to propose the openness of the SAP Cloud Platform (now SAP Cloud) with the following quotation.

“SAP Cloud Platform is an open platform-as-a-service (PaaS) that delivers in-memory capabilities, core platform services, and unique microservices for building and extending intelligent, mobile-enabled cloud applications. The platform is designed to accelerate digital transformation by helping you quickly, easily, and economically develop the exact p Platform offers complete flexibility and control (emphasis added) over your choice of clouds, frameworks, and applications.”

Based Upon Open Systems?

First, by the nature of their business models, SAP and Oracle do not create open cloud offerings. Therefore, this claim is highly dubious. SAP and Oracle can’t market their clouds effectively without embellishing their closed nature with open terminology.

Now while it may be true that the SAP Cloud “can” be connected to non-SAP assets, that rest assured that SAP would do everything it can to direct customers to use more SAP if they use the SAP Cloud. For instance, for some time, SAP has been proposing that the SAP Cloud improve SAP’s integration capabilities.

“Easily exchange data in real-time with SAP Cloud Platform Integration. Integrate processes and data between cloud apps, 3rd party applications and on-premises solutions with this open, flexible, on-demand integration system running as a core service on SAP Cloud Platform.”

How is this accomplished? Other questions naturally come to mind:

- Better Than Other Integration?: Why is this better than using another integration application? SAP has been guilty of making many previous exaggerated claims about its “platforms” that end up not being easier to use than competing offerings.

- On-Demand Integration?: What does “on-demand integration mean”? Any integration harness or application is on-demand for the people that use it.

- Runs as a Core Service?: What does it mean that it runs as a core service as part of the SAP Cloud Platform? Isn’t it part of the SAP Cloud Platform anyway?

SAP goes on to say the following about the SAP Cloud and integration’s key benefits:

“Access a deep catalog of integration flows.

Integrate both processes and data through unified technology engineered for the cloud.

Get an integration service that is secure, reliable and delivered and managed by SAP in SAP’s secure data centers across the globe.

Lower TCO with an affordable, pay-as-you-go subscription model and minimal up-front.”

The Evidence for Lower TCO with SAP Cloud?

Does SAP have any independent studies that can demonstrate that the SAP HANA Cloud Platform lowers TCO, or is this just a sales statement that has nothing to back it up? That is, of course, a rhetorical statement. We know SAP doesn’t. SAP usually does not provide evidence of TCO claims. One of the few times they did, when they paid Forrester to estimate HANA’s lower TCO claim, the study was unusable.

SAP goes onto say more:

“With SAP Cloud Platform Smart Data Integration, you can replicate, virtualize and transform data from multiple sources and store it in your SAP HANA instance on SAP Cloud Platform. Smart data integration offers pre-built adapters to common data sources plus an adapter SDK that lets you get data from any source for a 360-degree view of your business. Thanks to a cloud-first architecture your data is securely transferred from on-premises applications to the cloud without putting your business at risk.”

How about the SAP Cloud Platform Smart Data Integration item? SAP capitalizes this as if it is a product, not a process within a product. On the Cloud Platform’s pricing sheet, SAP Cloud Platform Integration is what pushes the customer into the $4,600 to $17,000 per month version of the SAP Cloud. However, we have seen very little use of this component or discussion of the component. SAP does not have a history of having developed a useful integration product, with their on-premises offering, SAP PO/PI becoming less popular with customers as time passes. Therefore it is no “slam dunk” that the SAP Cloud Platform Integration will become a desirable component to use. The probabilities are firmly against that ever happening. We cover this in more detail in the article How Accurate is SAP on SAP HANA Cloud Integration?

Also, most SAP customers don’t have HANA, and looking at the low growth rate of HANA, most never will. So what if the customer does not want HANA, can they use the SAP HANA Cloud Platform to store in Oracle, MongoDB, PostgreSQL, Tibero or another non-SAP database? The fact they can’t is a problem. SAP is all in on its databases being used in SAP Cloud. However, SAP’s databases are not that widely used.

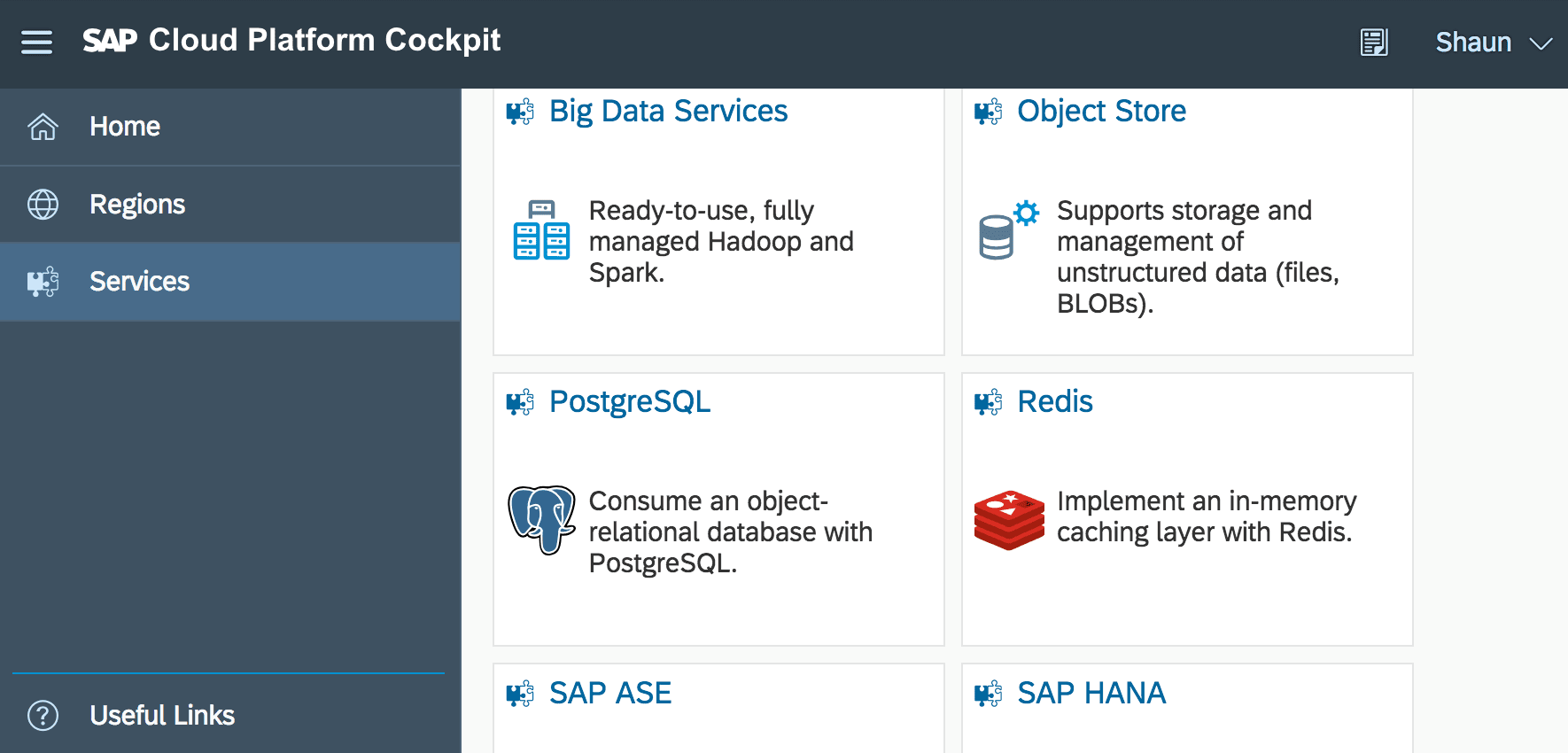

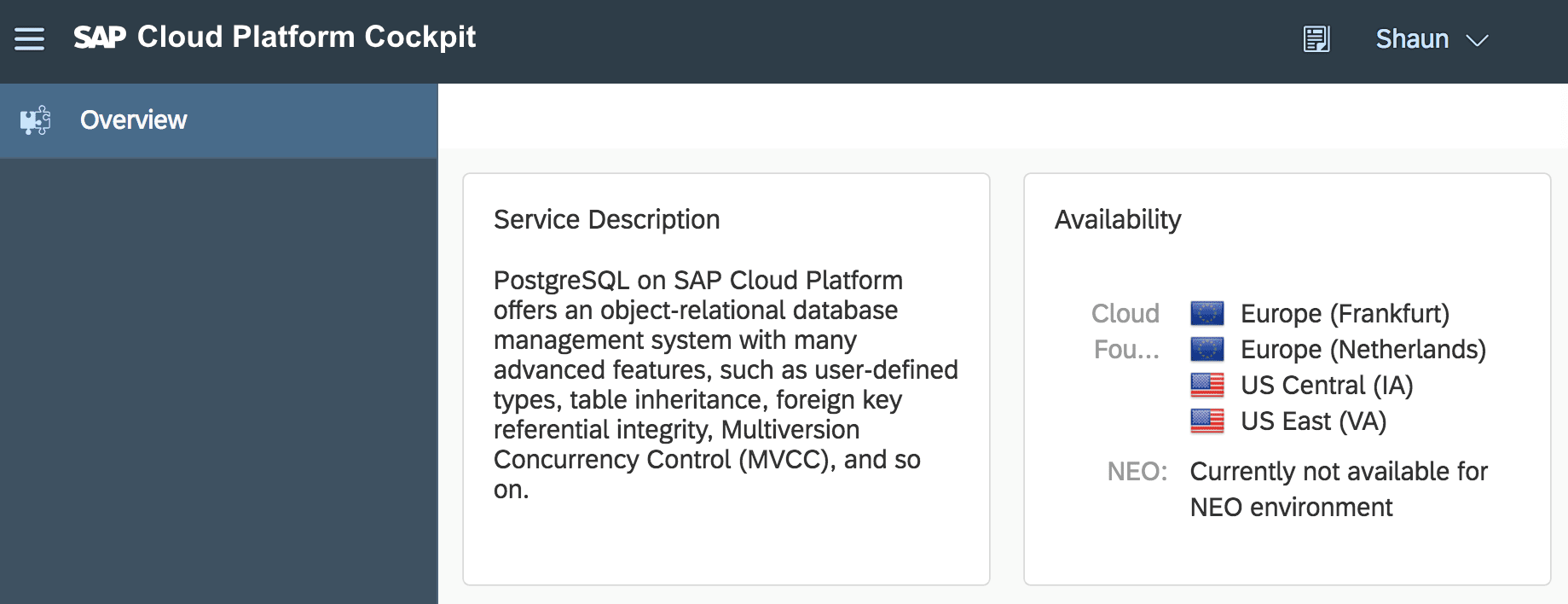

SAP has begun to offer a very limited number of non-SAP database options, including PostgreSQL and Redis.

However, when we select PostgreSQL, we find that it is not available for our environment, which is the more limited environment. Why? Because SAP does not offer it themselves, but through AWS, Google Cloud, or Azure.

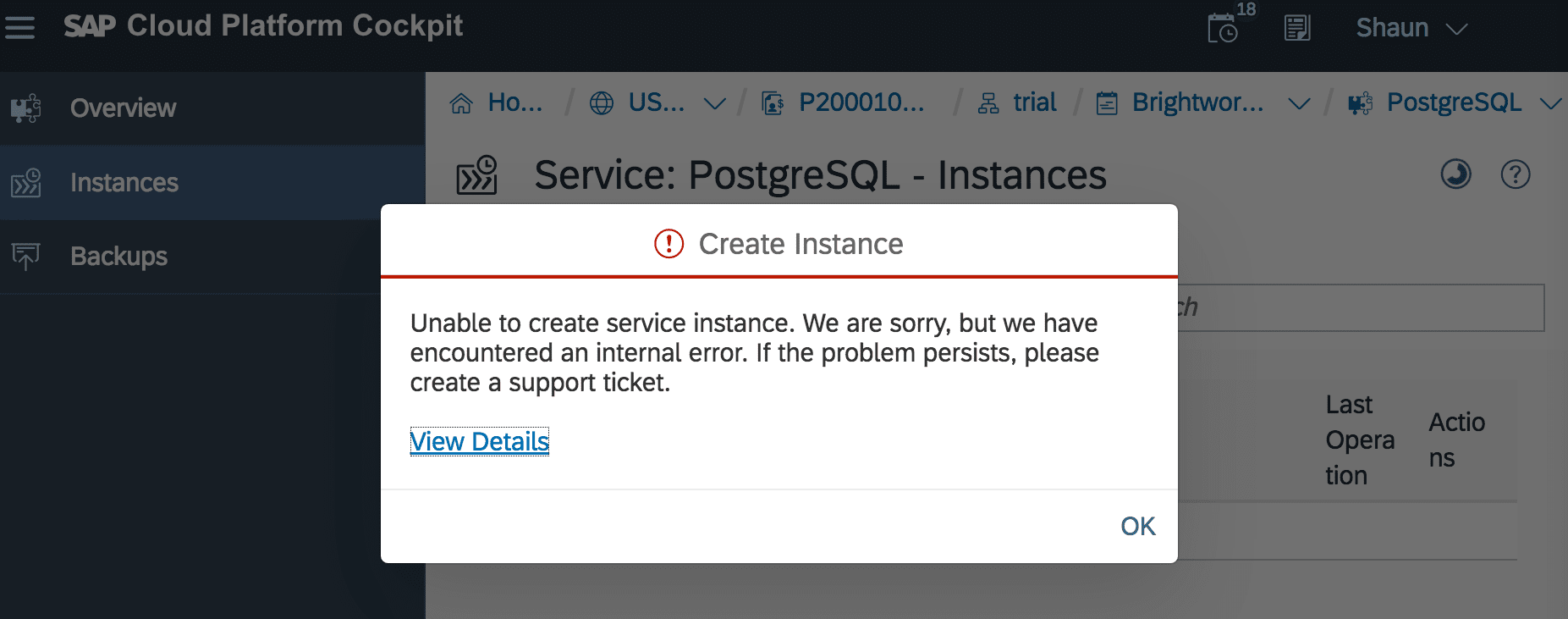

Once we switch into the Cloud Foundry, which has access to AWS, Google Cloud, or Azure, we can progress a short way in bringing up PostgreSQL, that is until we get this error. These types of errors do not come up when attempting to create a PostgreSQL instance in AWS or Google Cloud directly. This makes us wonder how much PostgreSQL or Redis, which is non SAP databases, have been added to SAP Cloud for marketing rather than for real usage purposes.

How Accurate was Fortune Magazine on SAP Cloud?

On Jan 22, 2016, published the article SAP Meets Cloud Sales Expectations, and Then Some.

In this article, we will review the accuracy of this article.

Article Quotations

“SAP convinced big businesses to sign up for cloud subscriptions to its business applications faster than anticipated during 2015—with a 103% increase in bookings to €883 million (or $955 million).”

SAP has a history of cloud washing, as it is what Wall Street wants to hear. The 103% figure is a doubling of cloud bookings. Which seems high.

SAP’s Cloud Growth Is Responsible for Margin Decline?

“But that growth is putting pressure on operating margins, which slipped to an estimated 25% compared with the 35% that SAP (SAP, +0.70%) used to earn traditionally, according to the company’s financial results.”

This seems to be the thrust of the article. SAP wants to convince people that their margins declined because they are transitioning to the cloud. However, the cloud portion of SAP’s business is not very large. SAP gets most of its revenue from on premises applications like ECC and the BW. Secondly, over 50% of SAP revenue is from support, and not from the software at all. Therefore, the explanation provided here sounds fishy.

“SAP executives say that’s to be expected, since the cloud model spreads out fees, which reduces short-term profits. They’ve already prepared investors for that eventuality, projecting margins in the 30% range during the multi-year transition period. “The margin is really uninteresting to me,” SAP’s CFO Luka Mucic said during a call to discuss the results. “There’s no reason cloud margin shouldn’t reach the level of on-premises software, but that will take substantially longer than this decade.”

A More Likely Explanation for Margin Decline

Yes, but that may not be the right explanation. Oracle and Microsoft and IBM are as a group facing lowered margins. But transitioning to the cloud is not the reason why. These are companies that have grown beyond the core offering that put them into their current positions. However, when expanding to new things, they do not have the same margins of the earlier offerings. For example,

- Microsoft: Microsoft receives 3/4 of its margin from just Windows and MS Office. Microsoft could shed the rest of its business and be a much smaller company with enormous margins. Microsoft has Azure, which provides little in the way of profits. However, lower profits are a feature of all of Microsoft’s offerings outside of Windows and MS Office, most of which are on premises offerings.

- Oracle: Oracle also has a lower margin outside of databases. Oracle receives 55% of its margins from its database business. Oracle expanded into a $38 billion behemoth. However, its investments in acquisitions did not have the profit margins of their databases — or their original product offerings.

Plenty of companies still prefer to buy traditional licenses for SAP’s software. That portion of the German software giant’s revenue generated 13% growth last year, reaching €14.9 billion (or about $16.1 billion).

SAP is mostly an on premises business, and outside of acquired applications that were already cloud, SAP does not do much in the cloud. Offerings like the HANA Cloud Platform are more for cloud washing than actual usage. And the quotation above makes it sound like customers have good options for the cloud for many other SAP offerings when they do not.

SAP Now Gets Over 60% of Revenue from the Cloud?

“When can we expect SAP to generate more value from cloud sales than traditional software licenses? That crossover could happen sometime in 2017. By that year, SAP expects revenue for cloud subscriptions and support to reach 63% to 65% of total revenue.”

That is entirely inaccurate. It is currently past the midpoint of 2017, and SAP does not get anywhere near 63% of revenue from the cloud.

Conflating Cloud and Support Revenues

“SAP’s cloud momentum inspired the company to boost its 2017 revenue projection to €23 billion to €23.5 billion (or $24.9 billion to $25.4 billion). Its cloud subscriptions and support revenue should reach €3.8 billion to €4 billion (or $4.11 billion to $4.33 billion) during that timeframe.”

What does support revenue have to do with cloud subscriptions? Support revenue is higher than this, but SAP is underplaying this number because it does not want to be seen as a Computer Associates type of company. But much of SAP’s software is out of date, and they are increasingly relying on the support.

SAP’s Core Offerings the Slowest Growing Part of Cloud?

“The fastest growing piece of SAP’s cloud business last year centered on the “business network” services provided by Concur (travel and expenses) and Ariba (procurement and supply chain services). Bookings reached €309 million ($334 million) in 2015, up 187%.”

So the fastest-growing part of SAP’s cloud business is the acquired products like Concur and Ariba. These were cloud vendors before being acquired by SAP. This means the products that SAP internally developed that are cloud are growing more slowly. Fortune could point this out, but this is a puff piece, so they are not going to do anything to contradict anything SAP says.

SAP Once Again Exaggerating S/4HANA

“Another big part of SAP’s cloud portfolio, the “Employee Central” component of the SuccessFactors human resources app, surpassed the 1,000-customer mark during the fourth quarter. SAP also reported more progress for S/4HANA, its next-generation suite of business applications. More than 2,700 SAP customers are using the technology, which means growth doubled quarter over quarter last year.”

That is not that many customers for Employee Central. S/4HANA sees very little progress and a lot of implementation problems. This is natural as SAP has exaggerated the completeness of S/4HANA, as is covered in the article Why the S/4HANA Suite is Not Yet Released.

On Aug 10, 2012, I published the article Competing For The Cloud: SAP.

In this article, we will review the accuracy of this article.

Article Quotations

Cloud computing has made life easy for millions of users. But it’s a different story for software companies providing those cloud-based services: the field is small, the game is fast and the battle for dominance is fierce. SAP is determined to win.

Nearly four decades ago, in center city Philadelphia on the East Coast of the USA, in a bohemian-chic historic little side street, stood a popular fantasy-filled boutique named “Vendo Nubes” – “I Sell Clouds”.

Today, in 2012, Jim Hagemann Snabe sells clouds, too, and he makes a lot more money at it than Vendo Nubes imagined was possible – not just for him but for the shareholders of enterprise software-maker SAP. As co-CEO (he’s the engineer, in charge of product development), Snabe’s mission is to actually own the cloud – the next stage of online computing.

“We have declared our intent to be the leader for business software in the cloud,” Snabe told INSEAD Knowledge on the sides of the Global Business Leaders Conference in Paris on July 6, 2012. “We are already the largest player today in terms of numbers of users consuming our services. We have more than 15.6 million users.”

But despite being Germany’s largest listed company by market capitalisation, SAP is not yet the number one player in the clouds. That spot is occupied by the legendary Salesforce.com. Snabe is duking it out with Larry Ellison, CEO of Oracle for the number-two position.

Forbes Pushing the Establishment View Regardless of Facts to the Contrary

This complete introduction reads like an establishment article that seems intent on reinforcing the positions of the largest software vendors. Salesforce is 100% SaaS, while SAP and Oracle are not. And many vendors are also SaaS and innovators in SaaS, so, curiously, Forbes would be talking about SAP and Oracle in this way. This article smells a bit like a paid placement on the part of SAP to make itself seem more “cloudy” than it is.

It’s a competition with a history of acrimony: in November of 2001, SAP lost the largest software privacy suit in history – a US$1.3 billion – to Oracle, conceding it had “inappropriately downloaded” Oracle software via its subsidiary, TomorrowNow, Inc. The verdict was overturned less than a year later but competition between the two companies remains.

Right, but what does that have to do with how much Oracle and SAP get in revenues from the cloud? Forbes moves from the contention on SAP and Oracle being competitors for the cloud, into the topic of their acrimony. This seems like a Kelly Ann Conway type pivot.

Buying Size and Expertise

Consequently, SAP is modifying its organic-growth policy to make key acquisitions in order to scale up fast: Sybase, Inc. as well as SuccessFactors, Inc., and this past May made a US$4.3 billion offer for California-based supply-chain global network operator Ariba, Inc.

Yes, SAP is buying its way into the cloud, as is covered in the article How SAP is Buying its Way into the Cloud. Although Sybase is not an example of this.

Combined with SAP’s resource planning and back office software, the system would be able to oversee operations all the way to network tracking and managing corporate purchases. Real streamlining. The U.S. Department of Justice thinks so, too – so much so that it’s concerned the Ariba purchase could accelerate an SAP-led price war and has asked for enough additional information under the Hart-Scott-Rodino anti-trust laws to nudge the deal’s closing into Q4 instead of Q3.

This is curious. Why is the FTC not doing this?

“Ariba is the next wave of cloud computing,” says Snabe. “We don’t believe in acquisition to consolidate the past. When we acquire, it’s been about identifying new categories where there was significant value-add for new customers. And the question we always ask ourselves is: are we able to get there faster through our own organic innovation or do we need a quantum leap to get into that market fast? Ariba run the largest marketplace for buying and selling between companies…they are the eBay for businesses (to date more than 730,000 customers), so it was obvious for us to go for the leader.”

That is the charitable explanation. Another explanation is that SAP’ cannot develop cloud offerings internally. I believe the second is true, as SAP has no examples of successes in the cloud that were developed internally.

It was also not obvious to go after Ariba, as Ariba’s primary domain expertise is indirect procurement. SAP would have been better off purchasing a procurement vendor that has focused on direct procurement, as a direct procurement application can be connected to the current procurement functionality within SAP’s ERP system.

Is SAP Growing in the SMB Space?

This acquisition also speaks to SAP’s changing customer base. When the company was founded in 1972 by five former IBM engineers in Mannheim Germany, ICI (Imperial Chemical Industries) was their first client. Early customers were specimens from the Fortune 500. Today, it’s small and medium-sized (SMEs) companies who are filling the order books. The kind of companies that really need help managing data, beyond traditional corporate data.

No, that is false. SAP has been trying to capture this customer base, but SAP is still highly concentrated in the largest companies. As a longtime SAP consultant, I can say that SAP’s software is inappropriate for the SMB market because its TCO is so high, and it is so complicated. Anything I need to do in SAP, I can do much more easily in just about any other application. SAP’s acquired products have a smaller customer size, but the internally developed products do not.

“In today’s world, you need to be able to analyse Twitter sentiments in order to understand your impact in this market and guide your efforts and promotions in the right directions,” points out Snabe. “In the cloud, the speed of innovation is extremely high and the deployment and delivery of services is hugely simplified.”

This is a comment about Big Data, which is a market SAP does not have much to do with and has little to offer companies. This is a throwaway conference-type statement. And Forbes does nothing to validate any of these statements. By challenging nothing, even when the information is false, they implicitly endorse it.

SAP has a history of cloud washing, as it is what Wall Street wants to hear. The 103% figure is a doubling of cloud bookings. Which seems high.

Yes, it does. SAP’s cloud sales are not growing 103% year over year.

SAP as UNICEF?

These kinds of new technologies are changing the way businesses are run and, says Snabe, the way we work and live. As an engineer, “What really gets me up in the morning is the opportunity for us to solve some of the resource-constrained challenges that this world has: we are now seven billion people; in the next thirty years we could be nine billion. We need to find new ways to solve challenges around water, energy, food, ways to optimise healthcare.” For example, SAP software can analyse the DNA of a cancer patient and identify the mutation to find the most effective medical treatment.

That is what gets Snabe up in the morning, or his extremely high compensation? If SAP is pitching the idea that they are focused on social good, they can drop the pretense. SAP is challenged in even treating its customers fairly. It has no history of doing anything, but profit-maximizing by any means necessary. So the idea that SAP is the new UNICEF is a bit difficult to swallow. Secondly, I study the quotations and the comments of the top executives at SAP, and this would be the last group of people I would want to come up with solutions to water, energy, food, or optimizing healthcare. The top executives at SAP are about monopolizing areas so they can maximize profits for SAP. They also lack the domain expertise to offer solutions in these areas. Instead, I would suggest they stick to selling software.

One problem that particularly worries Snabe is youth unemployment today, particularly in Europe. “Many of the innovations of the future require young people’s open mindset, and the diversity of bringing young people together in solving problems around energy, etc. We are in the final stages of launching a programme where we will offer education in our technology to unemployed young people in Europe…we have a very strange dilemma: on the one hand, unemployed young people; on the other, in the IT sector there are a lot of positions we can’t fill. So we felt that one of the obligations we have is to offer education to unemployed people and with that increase the level of skills and technology in Europe.”

You have got to be kidding. But this quotation is good to have as it is useful for sharing for comedic purposes.

SAP’s global presence is far-flung: a strong engineering force in Germany, Canada and Brazil; a huge lab in Palo Alto, California; more than six thousand people in India and a rapidly growing presence in China – 32 locations in all. Snabe is also able to identify significant growth in Europe, “We are able to grow through an increase in SMEs, who are in many ways global companies; they’re just smaller, but they still need world-class technology, just as the large companies get.”

Again, SAP is not growing its SME business.

SAP has had nine consecutive quarters of growth and ambitious plans to double the size of the company by 2015. It won’t be easy: the company’s “Business by Design” cloud service is still very short of its 2011 goal of 10,000 customers needed to keep pace with Oracle. But Snabe is undeterred. He owes it to long-distance running (it clears his head and lets new ideas come in) and a love of classical music.

It missed that plan. I notice how Forbes did not discuss how short ByDesign is of SAP’s projections. It is estimated that ByDesign has around 1100 customers. So yes, that is quite a bit short of 10,000. Because Snabe likes long-distance running and classical music, SAP should not be held accountable for repeatedly making inaccurate projections in the future. Right.

Leadership Rhythm and Self Indulgent Personality Preferences

“I like classical music because it’s on the one side a very structured form, where there’s no ambiguity about what’s being played; yet the real fantastic classical experience comes when there is an element of creativity in that system, coming from the individual musicians and the conductor.”

Wow, that is fantastic. We now know what it is like to be on a date with Snabe, but we are unsure what value this adds to the topic being covered. We are, however, waiting with bated breath to determine what Snabe likes about long-distance running!

It’s an echo of his leadership style and one which underscores his goal to be the dominant player in the cloud. “I don’t believe in the leader taking all of the decisions,” he says. “It’s my role to bring the best people together. But I also believe you need to be a very ambitious-type leader who sets ambitious targets for the team. Because if you’re not competing to be number one, you’re not competing.”

This quotation sounds like it came from George W Bush.

How Accurate was Fortune Magazine on SAP Going All-In on the Cloud?

On May 08, 2013, published the article SAP Goes All-In With the Cloud.

In this article, we will review the accuracy of this article.

Article Quotations

“FORTUNE — In case you haven’t heard, SAP is serious about the cloud. On Tuesday the enterprise software giant announced it will offer HANA, its in-memory database, as a monthly subscription service, delivered via the cloud.”

Years later, HANA is very rarely deployed from the cloud. We cover in the upcoming book How to Leverage AWS and Google Cloud for SAP & Oracle. SAP is trying to increase interest by offering a trial version of HANA on AWS, but it is still primarily an on-premises database in its deployment.

HANA Cloud?

“A limited cloud-based version of HANA was already available through Amazon (AMZN, +0.22%) Web Services. But SAP (SAP, +0.27%) says customers will now be able to access applications powered by HANA — think enterprise resource planning and customer relationship management tools — via SAP’s own cloud, which consists of seven data centers around the globe. Next week, the Germany-based company is expected to unveil more cloud-related announcements and share additional details on this new flavor of HANA at its annual customer conference in Florida.”

SAP had almost no customers for HANA on the web when this was written. Years later, little has changed. Fortune could have investigated this but decided not to.

“Last month, in its lastest reported earnings announcement, SAP said HANA software revenue tripled year-on-year, contributing 86 million euros in the most recent quarter. Along with mobile and web-based software, HANA represents new revenue opportunities for the company, whose bread and butter is selling large, on-premise software installations — and charging costly fees to support and maintain them.”

That part about costly fees is true. That is about it.

Why Fortune Thinks SAP and Oracle are Cloud Software Vendors

“Of course, SAP’s not the only traditional software company trying to branch out and prove it’s “all in” on the cloud. Late last year rival Oracle (ORCL, +0.25%) unveiled its ambitious goal of owning the entire cloud computing “stack” — from the underlying infrastructure to the apps. And earlier this week Adobe Systems (ADBE, +0.68%) announced it is getting rid of packaged software; from now on, creatives will have to buy their digital tools via a cloud-based, subscription model only.”

And neither of these companies get very much revenue from the cloud. Both Oracle and SAP built their business for decades on the basis of on-premises software.

Getting False Information From Vishal Sikka

SAP says its new offering aims to enable faster deployments and lower, more flexible pricing.

“Customers want more and more options in how they take advantage of the value SAP HANA brings,” Vishal Sikka, SAP’s head of technology and innovation, said in a release issued Tuesday. “With the SAP HANA Enterprise Cloud, we are delivering HANA at scale with instant value and no compromise. We are simplifying customers’ experience and expanding their choice in how they want to adopt SAP HANA, now bringing it to a massive scale for enterprise mission critical applications — and we are doing this without disruption through the cloud.”

Vishal Sikka is a completely unreliable source of information on anything related to SAP. One of his primary jobs was to mislead people about HANA. SAP HANA Enterprise Cloud never obtained many customers. HANA has customers, but they are almost entirely only premises and concentrated in the SAP BW application. HANA has seen no broad-scale adoption outside of BW.

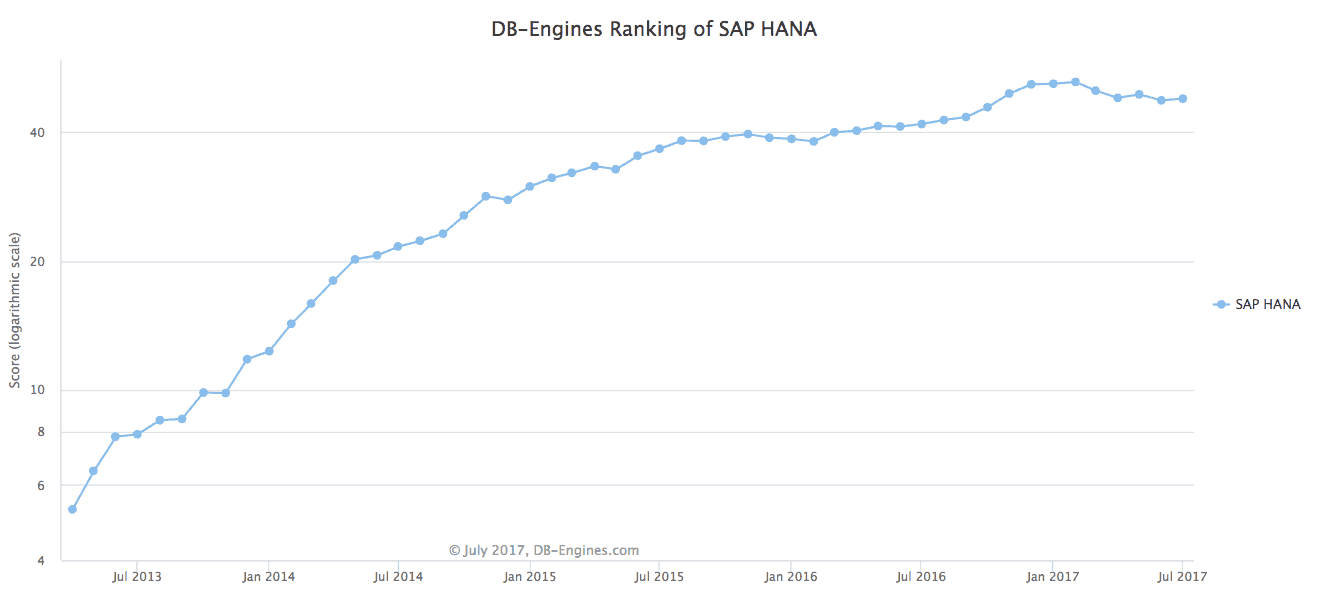

As I write this article, four years after this article was written, HANA’s popularity is on the decline.

Simplified Experience?

SAP and HANA never simplified the user’s experience as is covered in the article Is SAP’s Run Simple for Real? Run Simple was a marketing program that was eventually dropped. It was deceptive because nothing that SAP did or introduced ever made SAP any more simple. HANA dramatically increases the complexity of managing databases as HANA is such a high overhead database.

General Fortune Foolishness

“But SAP has yet to announce pricing for the new delivery method for HANA. And while getting up and running will be easier without having to invest in (and wait for) a dedicated, on-premise appliance, it isn’t as quite as quick and painless as ordering a book on Amazon.”

This is a fatuous statement, as HANA takes a lot of effort to maintain. And earlier versions of HANA are not compatible with later versions of HANA, as is covered in the article How to Best Understand Bloor Research’s HANA Paper. Why would Fortune compare this to buying a book?

Why would Fortune compare this to buying a book?

“In order to use HANA, customers first need to obtain licenses for HANA and applications that run on top of it. They then need to consult with SAP services workers, to help determine which applications are best moved to the HANA cloud, and to assist in “onboarding and migration.”

Why is Fortune explaining how a system implementation works?

Fortune Back on HANA Being Cloud-Based

“And just because HANA is now available as a subscription, cloud-based service doesn’t necessarily make it easier or cheaper to use.”

The assertion is correct, but irrelevant because almost no customers buy HANA as a cloud product.

“It’s still the same product, just delivered via a different mechanism. The proof, as they say, will be in the pudding. For now, stay tuned to next week, when SAP unveils more details on the new, cloud-based HANA.”

No, you can’t rely on information released by SAP. One must research everything SAP says.

Conclusions

SAP’s cloud revenues will increasingly come from their cloud markup business. SAP’s most significant cloud acquisitions, like Ariba and SuccessFactors, bring in little revenue. The only play that SAP has to get profits from the cloud is to use account control to customers and markup the cloud investments of real cloud service providers.