Executive Summary

- This is the Brightwork Research & Analysis software rating series.

- We rate both the software and estimate the risk of implementing each application.

MUFI Rating & Risk for AspenTech AspenOne

MUFI: Maintainability, Usability, Functionality, Implement ability

Vendor: AspenTech AspenOne (Select For Vendor Profile)

Introduction

AspenTech is one of the most industry-focused enterprise software vendors that we cover (the other being ProcessPro, which is similarly focused on the process manufacturing industry). Here we are profiling AspenTech’s planning product, but they have quite a variety of manufacturing software that has been built up over decades.

Application Detail

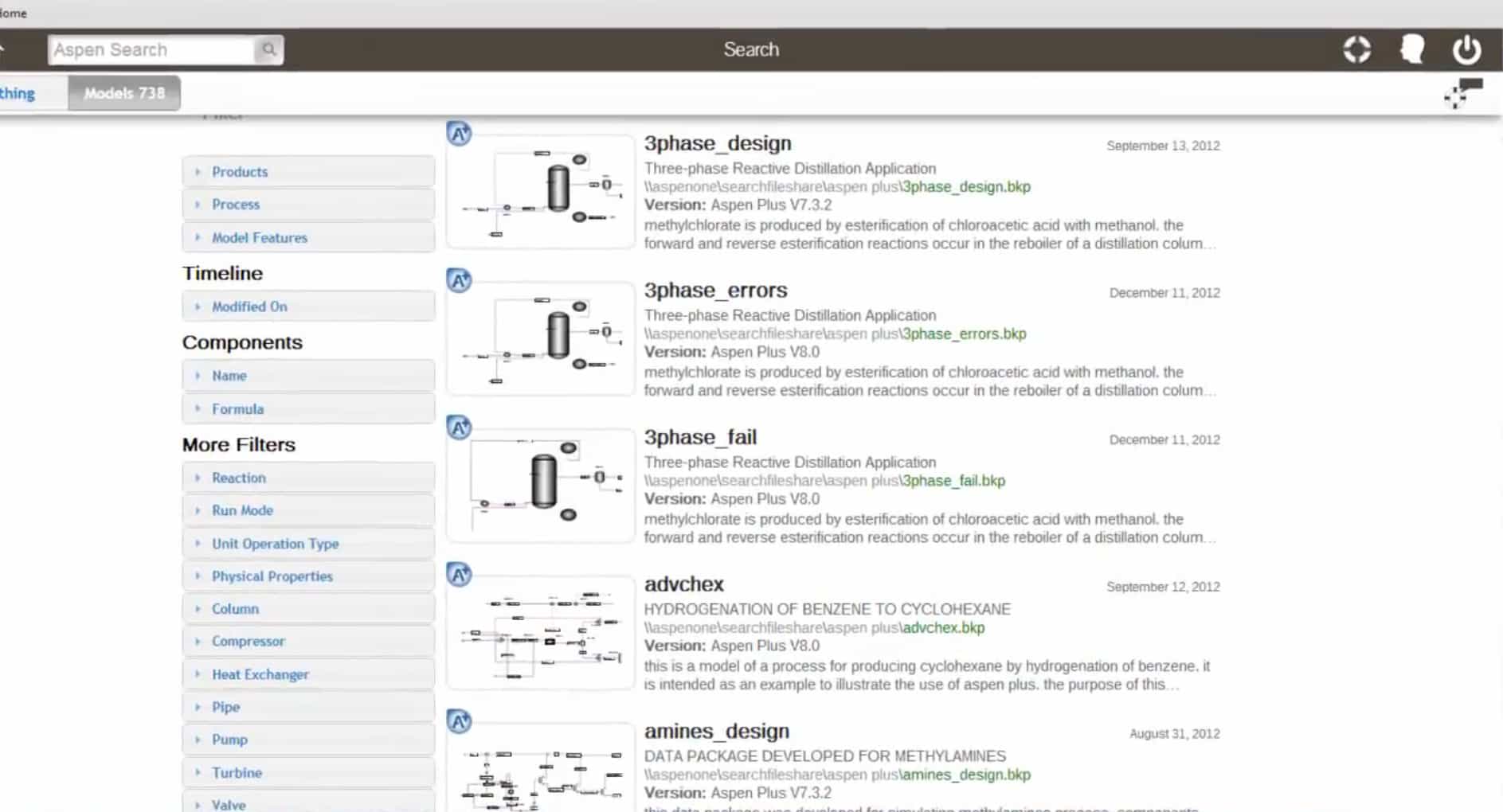

AspenTech creates very detailed modeling software. The user interface of its software shows the actual resources of the production process, and it looks like traditional simulation software. The user builds a model, or takes existing template models and can change them. AspenTech has a template for just about any model in the process industry – and their many years of experience with so many clients are demonstrated by the specificity of these models. A few examples are shown below:

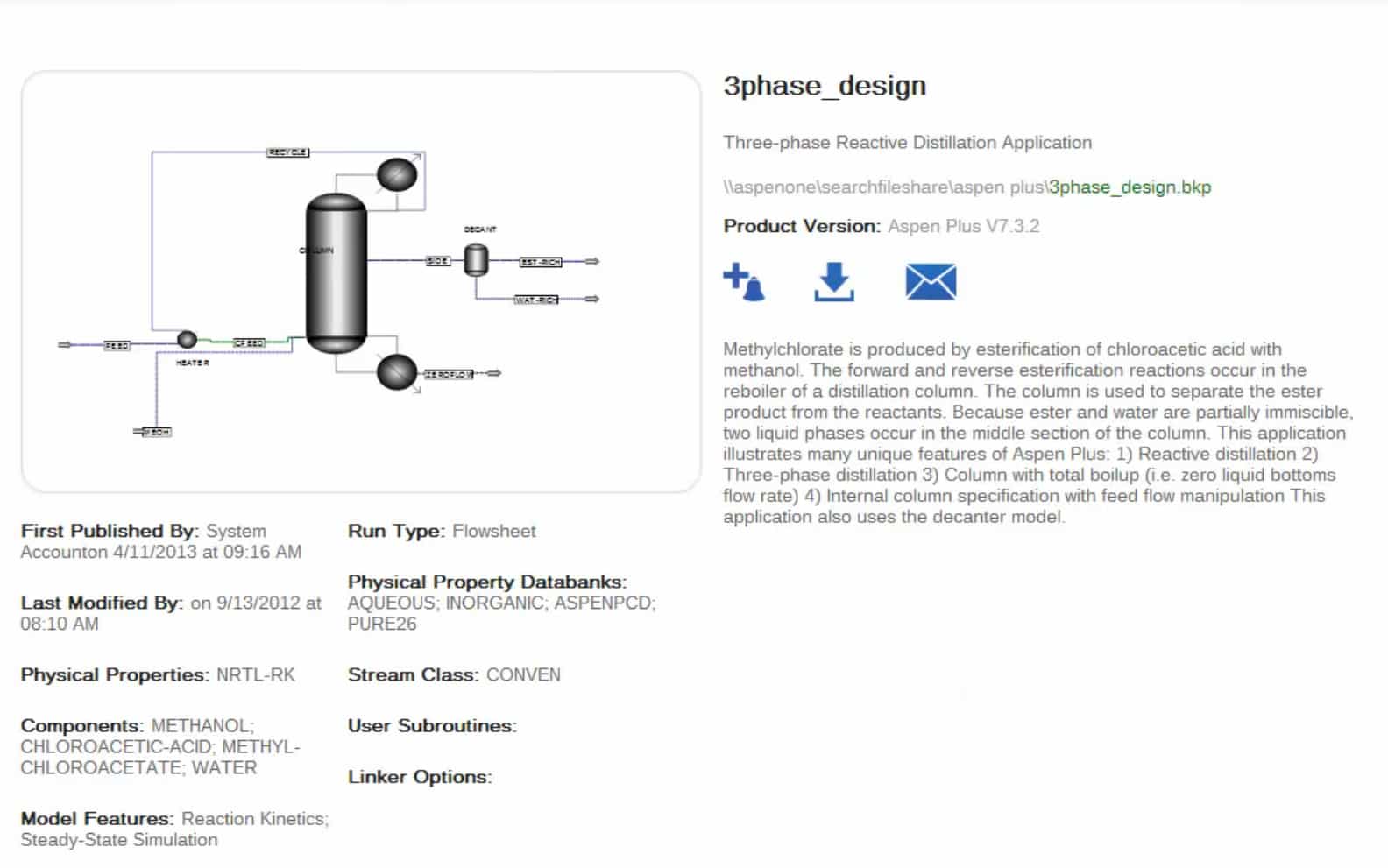

AspenTech has some prebuilt model templates, which can be used as a starting point to model various process industry environments. The specificity of the models to be selected is impressive. If we take the first, it is producing methylchorate through a process of esterification of chloroacetic acid with methanol. Because the model is so specific to this process, the settings that are included means that there is minimal actual configuration required when compared to other applications. Most applications just provide software that can be configured and there are very few templates of this type used in any production planning and scheduling application – in fact; there are very few templates of this type used in supply chain planning applications overall. Instead, the predominant approach is to have the model developed from scratch during the implementation. As soon as a model is selected, the specifics of that model are brought up as shown below:

This is a model for a three-phase reactive distillation application. This model is a particular configuration, which is designed for this manufacturing process. This is one of the real strengths of AspenTech – that for oil and gas industries it has such specific standards that can be applied and can control the model.

It is the detailed modeling with specific preset standards all customized for process industry manufacturing that is appealing to software buyers. AspenTech’s software encapsulates decades of implementations and knowledge of how various process manufacturing operations work. Not only are the processing rates for different process resources available within the application, but also the template models are based upon standardized process manufacturing operations, meaning even though the manufacturing process may be complicated, it can be modeled, and the system brought up quickly. There is not much like this on the discrete and repetitive manufacturing side where models tend to be setup from scratch.

AspenTech is an easy decision for heavy process industry manufacturing. AspenTech has the best software for a wide variety of process industry manufacturing environments that simply can’t be found anywhere else. AspenTech is one of the few vendors to achieve a perfect functionality score in our ratings. However, as our vendor profile indicates, we have some concerns about AspenTech’s management and their internal direction.

MUFI Scores

All scores out of a possible 10.

MUFI Scores

- Ma. = Maintainability

- Us. = Usability

- Fu. = Functionality

- Im. = Implementability

| App | Ma. | Us. | Ft. | Im. | Cat. |

|---|---|---|---|---|---|

| Average Score for Big ERP | 5.1 | 4.8 | 5.2 | 5.4 | Big ERP |

| Average Score for CRM | 6.2 | 6.2 | 5.1 | 5.9 | CRM |

| Average Score for Small and Medium ERP | 8.3 | 8 | 6.7 | 8.5 | Small and Medium ERP |

| Average Score for Finance | 8.8 | 8.8 | 8 | 8.8 | Finance |

| Average Score for Demand Planning | 7.6 | 7.2 | 7 | 7.1 | Demand Planning |

| Average Score for Supply Planning | 6.7 | 6.9 | 7 | 6.8 | Supply Planning |

| Average Score for Production Planning | 6.8 | 6.9 | 7 | 6.9 | Production Planning |

| Average Score for BI Heavy | 5.5 | 5.3 | 6.9 | 5.3 | BI Heavy |

| Average Score for PLM | 7 | 7.2 | 6.8 | 7.3 | PLM |

| Average Score for BI Light | 7.7 | 8.7 | 9 | 8.3 | BI Light |

| Arena Solutions Arena PLM | 10 | 10 | 10 | 10 | PLM |

| AspenTech AspenOne | 4 | 8 | 10 | 7 | Production Planning |

| Birst | 8 | 8.5 | 10 | 8 | BI Light |

| ERPNext | 10 | 10 | 7.5 | 10 | Small and Medium ERP |

| Delfoi Planner | 8 | 6 | 6.5 | 7 | Production Planning |

| Demand Works Smoothie SP | 9 | 10 | 7 | 10 | Supply Planning |

| Hamilton Grant RM | 10 | 9 | 8.5 | 9 | PLM |

| IBM Cognos | 2.7 | 3 | 1.5 | 3 | BI Heavy |

| Infor Epiphany | 7 | 8 | 6 | 5 | CRM |

| Infor Lawson | 8 | 7 | 6 | 7 | Big ERP |

| Intuit QuickBooks Enterprise Solutions | 9 | 9 | 5 | 9 | Finance |

| JDA DM | 9 | 7.5 | 8 | 8 | Demand Planning |

| Microsoft Dynamics CRM | 2 | 3 | 2 | 2 | CRM |

| NetSuite CRM | 6 | 4 | 3 | 3 | CRM |

| Netsuite OneWorld | 7 | 7 | 8 | 8 | Big ERP |

| OpenERP | 7 | 8 | 8.5 | 8 | 7 |

| Oracle BI | 4 | 4 | 3 | 6 | BI Heavy |

| Oracle CRM On Demand | 4 | 5 | 3 | 5 | CRM |

| Oracle Demantra | 5 | 3 | 3.5 | 4.5 | Demand Planning |

| Oracle JD Edwards World | 4 | 1 | 3 | 6 | Big ERP |

| Oracle RightNow | 6 | 7 | 4 | 5 | CRM |

| PlanetTogether Galaxy APS | 10 | 10 | 10 | 10 | Production Planning |

| Preactor | 8 | 7 | 3 | 7 | Production Planning |

| QlikTech QlikView | 9 | 9 | 10 | 9 | BI Light |

| Rootstock | 9 | 8 | 9 | 9 | Small and Medium ERP |

| Sage X3 | 8 | 8 | 7 | 8 | Big ERP |

| Salesforce Enterprise | 8 | 8.5 | 9 | 7.5 | CRM |

| SAP APO DP | 3 | 4 | 3 | 2 | Demand Planning |

| SAP APO PP/DS | 2 | 2 | 4 | 3 | Production Planning |

| SAP APO SNP | 3 | 4 | 8 | 4 | Supply Planning |

| SAP BI/BW | 1.5 | 2 | 4 | 2 | BI Heavy |

| SAP Business Objects | 3 | 2.5 | 7 | 3 | BI Heavy |

| SAP CRM | 4 | 3 | 6 | 4 | CRM |

| SAP ECC | 3 | 3 | 6.5 | 3 | Big ERP |

| SAP PLM | 1 | 2.5 | 2 | 3 | PLM |

| SAP SmartOps | 4 | 4 | 7 | 5.5 | Supply Planning |

| SAS BI | 6.5 | 7 | 9 | 6 | BI Heavy |

| SAS Demand Driven Forecasting | 7 | 8 | 9 | 7 | Demand Planning |

| Tableau (BI) | 9 | 10 | 10 | 10 | BI Light |

| Tableau (Forecasting) | 10 | 8 | 5 | 9 | Demand Planning |

| Teradata | 8 | 6.3 | 9.7 | 6 | BI Heavy |

| ToolsGroup SO99 (Forecasting) | 7 | 8 | 9 | 7 | Demand Planning |

| ToolsGroup SO99 (Supply) | 5 | 6 | 10 | 7 | Supply Planning |

Vendor and Application Risk

An implementation of AspenOne combined the implementation of a highly specialized and functional application with a dysfunction software vendor. This means staffing the project heavy with buyer resources. AspenTech consulting resources tend to be of good quality, but organizational issues will prevent them from being as effective as they could be.

Likelihood of Implementation Success

This accounts for both the application and vendor-specific risk. In our formula, the total implementation risk is application + vendor + buyer risk. The buyer specific risk could increase or decrease this overall likelihood and adjust the values that you see below.

Likelihood of Application Implementation Success and Failure

Search for the application in this table using the search bar in the upper right of the table.

| Application | Prob of Implementation Success | Prob of Implementation Failure |

|---|---|---|

| Actuate | 0.77 | 0.23 |

| SAP Smartops | 0.39 | 0.61 |

| NetSuite CRM | 0.46 | 0.54 |

| Sugar CRM | 0.62 | 0.48 |

| Base CRM | 0.91 | 0.09 |

| SAP CRM | 0.35 | 0.65 |

| Salesforce Enterprise | 0.72 | 0.28 |

| QlikTech QlikView | 0.82 | 0.18 |

| Tableau (BI) | 0.98 | 0.02 |

| SAP Crystal Reports | 0.46 | 0.54 |

| Brist | 0.83 | 0.17 |

| MicroStrategy | 0.7 | 0.3 |

| SAS BI | 0.76 | 0.24 |

| Oracle BI | 0.35 | 0.65 |

| IBM Cognos | 0.23 | 0.77 |

| Infor Epiphany | 0.58 | 0.42 |

| Microsoft Dynamics CRM | 0.26 | 0.74 |

| Oracle RightNow CRM | 0.41 | 0.59 |

| Oracle CRM On Demand | 0.36 | 0.64 |

| Teradata | 0.76 | 0.24 |

| SAP Business Objects | 0.32 | 0.68 |

| SAP BI/BW | 0.25 | 0.75 |

| SAP PLM | 0.29 | 0.71 |

| Hamilton Grant RM | 0.89 | 0.11 |

| Arena Solutions | 0.96 | 0.04 |

| Delfoi Planner | 0.7 | 0.3 |

| Preactor | 0.64 | 0.36 |

| PlanetTogether Galaxy APS | 0.96 | 0.04 |

| AspenTech AspenOne | 0.55 | 0.45 |

| SAP APO PP/DS | 0.27 | 0.73 |

| Demand Works Smoothie SP | 0.93 | 0.07 |

| ToolsGroup SO99 (Supply) | 0.82 | 0.18 |

| Demand Works Smoothie | 0.96 | 0.04 |

| Tableau (Forecasting) | 0.9 | 0.1 |

| SAS Demand Driven Forecasting | 0.82 | 0.18 |

| ToolsGroup SO99 (Forecasting) | 0.86 | 0.14 |

| JDA DM | 0.57 | 0.43 |

| Oracle Demantra | 0.33 | 0.67 |

| SAP APO DP | 0.28 | 0.72 |

| FinancialForce | 0.92 | 0.08 |

| Intacct | 0.98 | 0.02 |

| Intuit QB Enterprise | 0.8 | 0.2 |

| ERPNext | 0.9 | 0.1 |

| OpenERP | 0.78 | 0.22 |

| Rootstock | 0.91 | 0.09 |

| ProcessPro | 0.93 | 0.07 |

| Microsoft Dynamics AX | 0.4 | 0.6 |

| SAP Business One | 0.49 | 0.51 |

| Sage X3 | 0.62 | 0.38 |

| Infor Lawson | 0.58 | 0.42 |

| Epicor ERP | 0.4 | 0.6 |

| Oracle JD Edwards World | 0.31 | 0.69 |

| Oracle JD Edwards EnterpriseOne | 0.36 | 0.64 |

| SAP ERP ECC/R/3 | 0.32 | 0.68 |

| NetSuite OneWorld | 0.65 | 0.35 |

Risk Definition

See this link for more on our categorizations of risk. We also offer a Buyer Specific Risk Estimation as a service for those that want a comprehensive analysis.

Risk Management Approach

AspenOne is a skillful application and can perform production planning and scheduling of some process industry-manufacturing environment that no other application can. However, a risk with AspenOne implementations is that the implementation can develop a configuration that is difficult to maintain post go live. Slicing the overall implementation into mini-go lives can moderate this risk so that the buyer can become acclimated to running AspenOne in production sooner rather than later.

Finished With Your Analysis?

To go back to the Software Selection Package page for the Production Planning software category. Or go to this link to see other analytical products for AspenTech AspenOne.