Executive Summary

- This is the Brightwork Research & Analysis software rating series.

- We rate both the software and estimate the risk of implementing each application.

MUFI Rating & Risk for SAP SmartOps

MUFI: Maintainability, Usability, Functionality, Implement ability

Vendor: SAP (Select For Vendor Profile)

Introduction

SmartOps, before its acquisition by SAP in 2013, was one of the significant inventory optimization vendors. For some years SmartOps was involved in a partnership with SAP, where SAP was primarily a reseller of SmartOps. This was one of the primary ways that SmartOps became the best-known inventory optimization and multi echelon-planning (MEIO) vendor. It was not, as SmartOps has repeatedly proposed (or believes themselves) because they had the best technology.

Application Detail

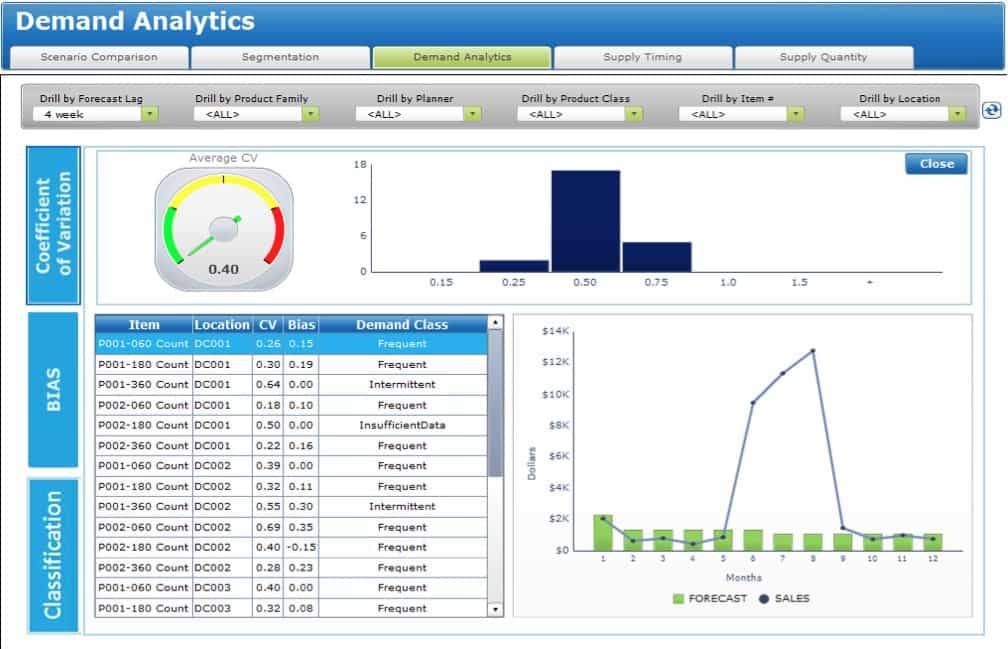

SNP is marketed as a leading solution, but it does not have the most advanced method in supply planning, which is inventory optimization and multi-echelon planning (MEIO). There are some reasons why MEIO is a far better method than cost optimization for supply planning. However, one of the most important is that service levels are far easier for companies to set than determining their costs.

SmartOps was always more of marketing phenomena than an innovation leader; therefore, its acquisition by SAP is a very logical move for the company. At SAP marketing is dominant, and technology is a distant second. SAP has been controlling SmartOps marketing messages essentially since they initiated their partnership — years before the acquisition.

SmartOps was the leading proponent of trying to simplify its marketing message to minimize what MEIO would do. MEIO should be used to replace the supply planning method and system. However, if SmartOps has taken this approach, it would have put them into conflict with companies like SAP. Therefore, they developed a marketing message which allowed MEIO to be viewed as adjunct or assistive technology to either the ERP system or to the already installed supply planning system. In this case, SmartOps, or the MEIO application calculates merely master data parameters – the most common being the target stock level and even more commonly safety stock. These parameters are then entered into the ERP system or planning system, and then these systems go through their routine planning. The SmartOps approach considerably adjusted how MEIO was used and oversimplified the work that was required for companies to get their application to work correctly. We do not have a separate SmartOps vendor profile because the company no longer exists as an independent entity, however, if we did, we would point out that SmartOps was always more focused on what was marketable versus what was correct. It was their marketing that differentiated them from other MEIO, making them the best selling MEIO application vendor. Still, unfortunately, this marketing has placed MEIO into a much smaller space than it should have been. This is one of many reasons that we consider the quality of the information provided by SmartOps provided to customers to have historically been extremely poor. We have observed this not only through reading their marketing documentation but also in participating in software selection presentations.

As all acquiring software vendors do, SAP announced that the SmartOps acquisition was going to allow them to be more strategic than ever as the following quotation attests.

SAP has acquired SmartOps in a move the company says will allow it to develop real-time supply chain applications that take advantage of SAP’s HANA in-memory database.

However, that is just for marketing purposes; in fact, the development of SmartOps will probably be only minimal from the time of the merger onward. This is a problem for buyers because SmartOps was a lagging application living off of its partnership with SAP when purchased, followed a flawed implementation approach (as described above), and has a low level of buyer satisfaction and a poor implementation track record.

For years SAP and SmartOps have been telling companies that these two solutions are integrated, but in fact, the integration of master data parameters is straightforward. The applications are not integrated regarding transactions, so there is no point in paying much extra for this integration. Secondly, because SmartOps is just an adjunct to SNP or SAP ERP, much of the benefit of having an MEIO application is lost. This is not a solution architecture designed around business requirements or based upon leveraging MEIO functionality but is a marriage of convenience based on the fact that the dominant software vendor is offering a dated solution to their customers.

Both SNP and SmartOps are weak applications that score in the bottom of the supply planning software category. Combining them (in fact there only needs to be one external planning system) will not make them better, and would lead the highest TCOs of any supply planning solution on the market.

MUFI Scores

All scores out of a possible 10.

MUFI Scores

- Ma. = Maintainability

- Us. = Usability

- Fu. = Functionality

- Im. = Implementability

| App | Ma. | Us. | Ft. | Im. | Cat. |

|---|---|---|---|---|---|

| Average Score for Big ERP | 5.1 | 4.8 | 5.2 | 5.4 | Big ERP |

| Average Score for CRM | 6.2 | 6.2 | 5.1 | 5.9 | CRM |

| Average Score for Small and Medium ERP | 8.3 | 8 | 6.7 | 8.5 | Small and Medium ERP |

| Average Score for Finance | 8.8 | 8.8 | 8 | 8.8 | Finance |

| Average Score for Demand Planning | 7.6 | 7.2 | 7 | 7.1 | Demand Planning |

| Average Score for Supply Planning | 6.7 | 6.9 | 7 | 6.8 | Supply Planning |

| Average Score for Production Planning | 6.8 | 6.9 | 7 | 6.9 | Production Planning |

| Average Score for BI Heavy | 5.5 | 5.3 | 6.9 | 5.3 | BI Heavy |

| Average Score for PLM | 7 | 7.2 | 6.8 | 7.3 | PLM |

| Average Score for BI Light | 7.7 | 8.7 | 9 | 8.3 | BI Light |

| Arena Solutions Arena PLM | 10 | 10 | 10 | 10 | PLM |

| AspenTech AspenOne | 4 | 8 | 10 | 7 | Production Planning |

| Birst | 8 | 8.5 | 10 | 8 | BI Light |

| ERPNext | 10 | 10 | 7.5 | 10 | Small and Medium ERP |

| Delfoi Planner | 8 | 6 | 6.5 | 7 | Production Planning |

| Demand Works Smoothie SP | 9 | 10 | 7 | 10 | Supply Planning |

| Hamilton Grant RM | 10 | 9 | 8.5 | 9 | PLM |

| IBM Cognos | 2.7 | 3 | 1.5 | 3 | BI Heavy |

| Infor Epiphany | 7 | 8 | 6 | 5 | CRM |

| Infor Lawson | 8 | 7 | 6 | 7 | Big ERP |

| Intuit QuickBooks Enterprise Solutions | 9 | 9 | 5 | 9 | Finance |

| JDA DM | 9 | 7.5 | 8 | 8 | Demand Planning |

| Microsoft Dynamics CRM | 2 | 3 | 2 | 2 | CRM |

| NetSuite CRM | 6 | 4 | 3 | 3 | CRM |

| Netsuite OneWorld | 7 | 7 | 8 | 8 | Big ERP |

| OpenERP | 7 | 8 | 8.5 | 8 | 7 |

| Oracle BI | 4 | 4 | 3 | 6 | BI Heavy |

| Oracle CRM On Demand | 4 | 5 | 3 | 5 | CRM |

| Oracle Demantra | 5 | 3 | 3.5 | 4.5 | Demand Planning |

| Oracle JD Edwards World | 4 | 1 | 3 | 6 | Big ERP |

| Oracle RightNow | 6 | 7 | 4 | 5 | CRM |

| PlanetTogether Galaxy APS | 10 | 10 | 10 | 10 | Production Planning |

| Preactor | 8 | 7 | 3 | 7 | Production Planning |

| QlikTech QlikView | 9 | 9 | 10 | 9 | BI Light |

| Rootstock | 9 | 8 | 9 | 9 | Small and Medium ERP |

| Sage X3 | 8 | 8 | 7 | 8 | Big ERP |

| Salesforce Enterprise | 8 | 8.5 | 9 | 7.5 | CRM |

| SAP APO DP | 3 | 4 | 3 | 2 | Demand Planning |

| SAP APO PP/DS | 2 | 2 | 4 | 3 | Production Planning |

| SAP APO SNP | 3 | 4 | 8 | 4 | Supply Planning |

| SAP BI/BW | 1.5 | 2 | 4 | 2 | BI Heavy |

| SAP Business Objects | 3 | 2.5 | 7 | 3 | BI Heavy |

| SAP CRM | 4 | 3 | 6 | 4 | CRM |

| SAP ECC | 3 | 3 | 6.5 | 3 | Big ERP |

| SAP PLM | 1 | 2.5 | 2 | 3 | PLM |

| SAP SmartOps | 4 | 4 | 7 | 5.5 | Supply Planning |

| SAS BI | 6.5 | 7 | 9 | 6 | BI Heavy |

| SAS Demand Driven Forecasting | 7 | 8 | 9 | 7 | Demand Planning |

| Tableau (BI) | 9 | 10 | 10 | 10 | BI Light |

| Tableau (Forecasting) | 10 | 8 | 5 | 9 | Demand Planning |

| Teradata | 8 | 6.3 | 9.7 | 6 | BI Heavy |

| ToolsGroup SO99 (Forecasting) | 7 | 8 | 9 | 7 | Demand Planning |

| ToolsGroup SO99 (Supply) | 5 | 6 | 10 | 7 | Supply Planning |

Vendor and Application Risk

SmartOps faces similar issues of the problems that come with socializing inventory optimization. In reviewing post-go-live projects with various buyers of inventory optimization software, it is quite common for many of the business users and the executives not to understand how inventory optimization works. SmartOps deliberately understates the complexity of inventory optimization to get the sale, which makes implementation difficult. There are also serious sustainability concerns when SmartOps is co-implemented with SAP SNP, as SNP already consumes so many resources to keep operational.

Likelihood of Implementation Success

This accounts for both the application and the vendor-specific risk. In our formula, the total implementation risk is application + vendor + buyer risk. The buyer specific risk could increase or decrease this overall likelihood and adjust the values that you see below.

Likelihood of Application Implementation Success and Failure

Search for the application in this table using the search bar in the upper right of the table.

| Application | Prob of Implementation Success | Prob of Implementation Failure |

|---|---|---|

| Actuate | 0.77 | 0.23 |

| SAP Smartops | 0.39 | 0.61 |

| NetSuite CRM | 0.46 | 0.54 |

| Sugar CRM | 0.62 | 0.48 |

| Base CRM | 0.91 | 0.09 |

| SAP CRM | 0.35 | 0.65 |

| Salesforce Enterprise | 0.72 | 0.28 |

| QlikTech QlikView | 0.82 | 0.18 |

| Tableau (BI) | 0.98 | 0.02 |

| SAP Crystal Reports | 0.46 | 0.54 |

| Brist | 0.83 | 0.17 |

| MicroStrategy | 0.7 | 0.3 |

| SAS BI | 0.76 | 0.24 |

| Oracle BI | 0.35 | 0.65 |

| IBM Cognos | 0.23 | 0.77 |

| Infor Epiphany | 0.58 | 0.42 |

| Microsoft Dynamics CRM | 0.26 | 0.74 |

| Oracle RightNow CRM | 0.41 | 0.59 |

| Oracle CRM On Demand | 0.36 | 0.64 |

| Teradata | 0.76 | 0.24 |

| SAP Business Objects | 0.32 | 0.68 |

| SAP BI/BW | 0.25 | 0.75 |

| SAP PLM | 0.29 | 0.71 |

| Hamilton Grant RM | 0.89 | 0.11 |

| Arena Solutions | 0.96 | 0.04 |

| Delfoi Planner | 0.7 | 0.3 |

| Preactor | 0.64 | 0.36 |

| PlanetTogether Galaxy APS | 0.96 | 0.04 |

| AspenTech AspenOne | 0.55 | 0.45 |

| SAP APO PP/DS | 0.27 | 0.73 |

| Demand Works Smoothie SP | 0.93 | 0.07 |

| ToolsGroup SO99 (Supply) | 0.82 | 0.18 |

| Demand Works Smoothie | 0.96 | 0.04 |

| Tableau (Forecasting) | 0.9 | 0.1 |

| SAS Demand Driven Forecasting | 0.82 | 0.18 |

| ToolsGroup SO99 (Forecasting) | 0.86 | 0.14 |

| JDA DM | 0.57 | 0.43 |

| Oracle Demantra | 0.33 | 0.67 |

| SAP APO DP | 0.28 | 0.72 |

| FinancialForce | 0.92 | 0.08 |

| Intacct | 0.98 | 0.02 |

| Intuit QB Enterprise | 0.8 | 0.2 |

| ERPNext | 0.9 | 0.1 |

| OpenERP | 0.78 | 0.22 |

| Rootstock | 0.91 | 0.09 |

| ProcessPro | 0.93 | 0.07 |

| Microsoft Dynamics AX | 0.4 | 0.6 |

| SAP Business One | 0.49 | 0.51 |

| Sage X3 | 0.62 | 0.38 |

| Infor Lawson | 0.58 | 0.42 |

| Epicor ERP | 0.4 | 0.6 |

| Oracle JD Edwards World | 0.31 | 0.69 |

| Oracle JD Edwards EnterpriseOne | 0.36 | 0.64 |

| SAP ERP ECC/R/3 | 0.32 | 0.68 |

| NetSuite OneWorld | 0.65 | 0.35 |

Risk Definition

See this link for more on our categorizations of risk. We also offer a Buyer Specific Risk Estimation as a service for those that want a comprehensive analysis.

Finished With Your Analysis?

To go back to the Software Selection Package page for the Supply Planning software category. Or go to this link to see other analytical products for SAP SmartOps.

References

https://www.computerworld.com/s/article/9237117/SAP_adds_to_supply_chain_tech_with_SmartOps_acquisition