What is the Real Story of How IBM will Use Red Hat?

Executive Summary

- IBM purchased Red Hat. However, how real will the benefits be for IBM customers?

- In this article, we separate the fluff from the reality of Open Shift and IBM.

Introduction

There is an extraordinary amount of coverage of the IBM purchase of Red Hat. However, there has been little critical analysis of the acquisition.

IBM and Red Hat and Open Shift

IBM made a significant bet on containers and Kubernetes being the future of the hybrid cloud. They paid a 63% premium over Red Hat’s share price to acquire Red Hat, and this was in an already overheated stock market price.

[1] The purchase was made primarily to access Red Hat’s Open Shift customers. Open Shift is a layer that sits on top of Kubernetes and Docker.

[2] Red Hat describes Open Shift as follows:

“It’s hard to abstract the varied benefits of multicloud deployments, but deploying containers in clouds helps an enterprise use the right cloud for the right project. Red Hat OpenShift is a complete container application platform built on Kubernetes—an open source platform that automates Linux container operations and management so each container has policies telling it how and where to run. Every container is inherently designed to run on Linux, so deploying Red Hat OpenShift on Red Hat Enterprise Linux brings more security to every container and better consistency across environments. If you need everything at once (the cloud infrastructure + a container platform), Red Hat Cloud Suite combines a container-based app development platform, private cloud infrastructure, public cloud interoperability, and a common management framework into a single, easily deployed solution.” [3]

IBM’s plan with Open Shift and Red Hat generally, we project, is twofold.

- Use Open Shift to push customers to IBM’s Cloud.

- Use Red Hat to sell other associated products and services.

- Sell Red Hat to existing customers and create a management service for hybrid cloud.

Use Open Shift to Push Customers to IBM’s Cloud

IBM can use Red Hat’s Open Shift container application platform to “intermediate” between the different cloud service providers. There are several problems with this strategy. One is that while IBM has promised that Red Hat will operate as “Switzerland,” there is nothing in IBM’s history to indicate they will follow through on this. Therefore, IBMs desultory cloud services will want to pressure Red Hat to use Open Shift to funnel customers away from AWS and Google Cloud, and Azure and towards IBM Cloud. That would have been

a primary reason for IBM to make the acquisition. However, to pull this off, IBM must broadcast that Red Hat will remain neutral while doing the exact opposite behind the scenes. As IBM paid a very significant premium for Red Hat, they will need to

monetize the purchase, which will mean leveraging Red Hat for self-centered rather than customer priorities. IBM has almost said as much.

“This is a very good opportunity to cross sell,”[4]

Correct. Also, IBM Cloud services are a primary item to cross-sell, and these services are uncompetitive. They can’t make very much progress in the market on their own in a level playing field, which is why IBM, in part, needs Red Hat to push customers to a service that they would not ordinarily use. This means that a big part of the acquisition will be for Red Hat to have its customer base

harvested by IBM and redirect cloud purchases away from the competitive providers to an uncompetitive provider. And to do this, Red Hat would have to become biased towards IBM Cloud. No doubt, efforts will be made in marketing to propose that Open Shift has been engineered by IBM to “work best” with IBM Cloud. This will mean IBM lying to Red Hat’s current customers by saying they will do one thing and then doing another.

How do we know this?

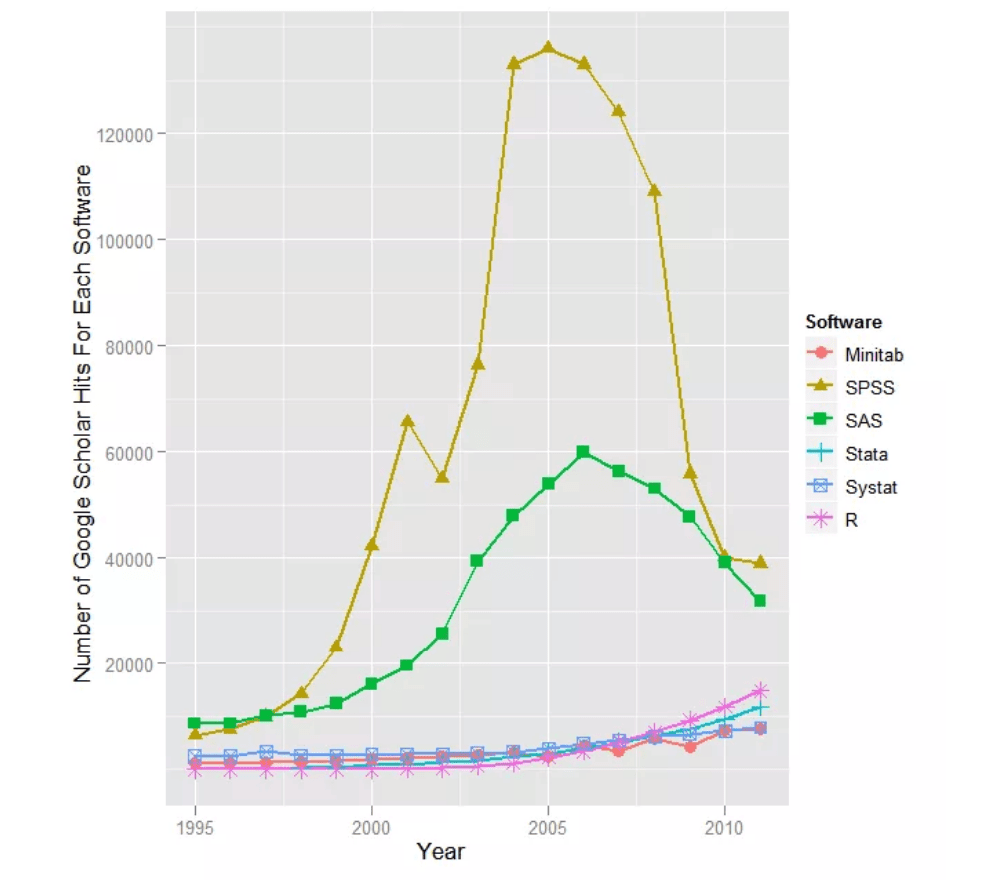

Well, the authors have plenty of experience with IBM. If we look at previous IBM acquisitions, this pattern is quite clear. In the statistical application SPSS, the first thing IBM did was “overmonetize” the acquisition in 2009. IBM’s acquisitions are entirely consistent. IBM announces acquisition and how it will be fantastic for customers while at the same time making the acquired item less appealing either through price increases or control and interference.

The following quote is typical of the analyst’s reaction to acquisitions.

“UBS analyst Maynard Um called the acquisition “a step in the right direction” for IBM, as SPSS will add “an essential part” of an important growth area for IBM. He said the deal should add slightly to IBM’s earnings in 2010.”

[5]

However, did SPSS grow after IBM purchased it? It should have. Of course, it would, with SPSS being pushed by IBM’s salesforce.

So what happened?

This is the usage of SPSS in academic articles.

[1]

Notice the aggressive decline before but continuing after the acquisition. As a user of statistical packages, we no longer considered SPSS and option after IBM made the acquisition and moved to use R. Our view is that customers should migrate off of any product that is acquired by IBM, when possible. IBM makes acquisitions to access customers and then milk them.

Invariably, this is what private companies do when they purchase previously independent items (Red Hat was also a private company, but they were never before contained the bias of being owned by a cloud service provider. And for executive compensation reasons, IBM is desperate to show growth in its cloud services.) IBM has tried to recast its private cloud/data center operations as part of the “cloud.”

Time to Crank Up the Smoke and Mirror Machine

IBM has already begun making false statements about Red Hat. This means that the hype around Kubernetes and Open Shift is set to rise to the highest possible levels. Here are some examples of quotations from IBM about the acquisition.

“Deal accelerates IBM’s high-value business model, making IBM the #1 hybrid cloud provider in an emerging $1 trillion growth market.”

Is IBM the #1 hybrid cloud provider? So was Red Hat the #1 hybrid cloud provider before the acquisition? No. This quotation highly overstates IBM’s centrality to the cloud. IBM has extremely little public cloud business, with most of its related business being public cloud or hosted. How a company can recast its previous inability to do much of anything in the cloud as now being central to the cloud is a fantastic bit of propaganda.

“IBM to maintain Red Hat’s open source innovation legacy, scaling its vast technology portfolio and empowering its widespread developer community”

Open Shift is already open source. However, it isn’t easy to see how IBM will empower its developer community. That developer community was doing fine without IBM. This acquisition is not about empowering Open Shift; it’s about accessing Red Hat’s customers.

“This brings IBM a collection of relatively sticky software clients, many of whom are undergoing a transition into shifting their IT — be it back office plumbing or client-facing platforms — onto the cloud.”

[4]

There is no reason to accept IBM’s statements here at face value without looking at its history.

“The acquisition of Red Hat is a game-changer. It changes everything about the cloud market,”

Why is any of this quote accurate?

Any company that wanted to could have used Open Shift before IBM acquired Red Hat. IBM already had a partnership with Red Hat. Was that partnership ineffective? Red Hat was beating IBM in sales in key areas, which is a primary reason for the acquisition.

“Most companies today are only 20 percent along their cloud journey, renting compute power to cut costs,” she said. “The next 80 percent is about unlocking real business value and driving growth. This is the next chapter of the cloud. It requires shifting business applications to hybrid cloud, extracting more data and optimizing every part of the business, from supply chains to sales.” –

Ginni Rometty, IBM CEO

[5]

If Ginni Rometty thinks that the primary or only reason companies use the cloud is to rent compute power to cut costs, they do not know much about the cloud. Companies use cloud services to access services that are not feasible to spin up on-premises, access the open-source, and get exposed to the most advanced items in computing at both low cost and low lock-in. Brightwork Research & Analysis uses cloud services to test advanced services quickly and easily (and to shut them down after testing), to keep away from any on-premises investments outside of laptops and screens, and to access these cloud providers international network of server farms that provide low latency to any part of the globe. A big part of using the cloud is to get away from companies like IBM, SAP, Microsoft, and Oracle that follow the lock-in model.

“IBM and Red Hat also will continue to build and enhance Red Hat partnerships, including those with major cloud providers, such as Amazon Web Services, Microsoft Azure, Google Cloud, Alibaba and more, in addition to the IBM Cloud.”

[6]

IBM and Red Hat will continue to build and enhance Red Hat partnerships with AWS, Azure, Google Cloud, Alibaba, and IBM Cloud equally? Is IBM promising that it won’t leverage Red Hat into more business for IBM Cloud?

Use Red Hat to Sell Other Associated Products and Services

IBM is always interested in selling consulting services. Red Hat presents them with a way of doing this. IBM also owns a variety of Red Hat-related products, which it can also sell to Red Hat customers. This is where customers of Red Hat will have to be very careful, as the IBM sales teams will be coming for them and told that they need to sell into Red Hat’s base to leverage the acquisition. And the information that Red Hat sales reps provide to their customers will take a steep dive. In our

Honest Vendor Ratings, IBM scores very low in information quality.[7] By contrast, Red Hat has been one of the good actors in the open-source movement.

Sell Red Hat into Existing Customers and Create a Management Service for Hybrid Cloud

Under this strategy, IBM serves as an intermediary between all cloud service providers. Let us review some of the issues.

- What is IBM’s value doing this over a customer just taking the Red Hat Open Shift software?

- Is IBM qualified to explain all of the cloud options available in the different cloud service providers to clients? Secondly, with the first part of the strategy to push IBM Cloud, can IBM be trusted to do this? If IBM understood cloud environments so well, why has their cloud been such a lagging offering?

- Red Hat is undoubtedly experts in cloud services and container management, but customers won’t just be dealing with an independent Red Hat now. They will be dealing with Red Hat’s new landlords, who, by the way, have a bit of a reputation for micromanaging acquisitions.

A Company That Must Acquire or Die

IBM was always known as a company that used its monopoly position in data processing machines to extract extremely high service fees from their clients. However, for much, if not most of its history, it can be considered an innovative company.

It is always predatory. IBM used to add value to the economy, instead of just extracting from it, with products like all-transistor 1401.

Those days are past it. Now IBM is both unethical and necessarily an empty blue suit when it comes to innovation. They retain a relatively small R&D group that exists primarily for PR or glamor projects like the IBM vs. Gary Kasparov chess competition. Almost all of their software is purchased, and soon after purchase, the software and development teams are reorganized, bureaucratized, and gradually become either a lagging package or completely irrelevant. This happened to Lotus and is in the process of happening to ILOG and SPSS. The act of IBM buying an application that you already own is a signal that it is time to consider its replacement.

What Happens to Vendors Acquired by IBM?

IBM acquires many software vendors, but the evidence is that these vendors gradually lose their relevance over time and that they move from being innovators to laggards in the marketplace. This is not actually that damaging to IBM because they only need their acquisition to be viable for a few years before making their money back with their lucrative consulting work, which is partially at least based on their ability to acquire firms.

What Occurs

- IBM salespeople now hit up current customers of an application, and their application costs increase.

- The software investment is diminished because IBM is not able to develop the product further very much, and in fact, that is not even IBM’s focus.

- IBM begins recommending whatever software they purchase through their consulting business.

(how a major consulting firm can objectively recommend products which it sells and maintain its objectivity is difficult to understand)

The Public Interest

The problem with all of this is that it is challenging to see how this benefits anyone but IBM. The determination of what companies can merge is a question for the government and must pass a standard of public interest benefit, or at least that is the official story. For instance, the recent attempt by ATT to acquire T-Mobile was not allowed because it could pass a public interest test. ATT wanted the enhanced market power of T-Mobile but is not interested in submitting to the type of regulation that prevents ATT from gouging customers that would have fewer placed to turn. Generally, the government is, in my view, far too lenient on allowing mergers as few mergers benefit the consumers or buyers of a product or service.

However, these companies are major financial contributors. Interestingly with all the rhetoric about competition, few companies seem willing to compete and want to grow through agglomerations and concentrating their market power with other companies.

Policy Perspective

Form an enterprise policy perspective. There is an obvious problem with allowing a company to acquire software vendors to enhance its monopoly position, mainly when there is a tie between a business that partially performs advisement (IBM Global Services) and selling software. It also harms innovation in the software marketplace. The product CPLEX is an excellent example of this problem. CPLEX is a general optimizer used as a standalone product and incorporated into many enterprise software applications. For instance, SAP’s supply network and production planning modules are powered by CPLEX. However, now that IBM owns it, CPLEX has been captured. I am hesitant to recommend CPLEX to a client because it comes with all the IBM overhead and manipulation of an IBM account manager trained to “penetrate and radiate the client.”

This is bad for clients and waste. After all, it means that my investment in CPLEX is diminished because it is no longer an independent company, and little future development can be expected from CPLEX. This problem is repeated with any software which IBM acquires, and they have a considerable number of acquisitions in their stable. I have several good relationships with the best-of-breed supply chain vendors, and if any of them were to be purchased, my relationship with them would probably end as they would then be mired in the bureaucracy of IBM. I cannot in good conscience recommend a product owned by IBM because this allows the “camel’s head into the tent.”

Buying Back Stock Over R&D

There is a problem in the US, which is more significant than IBM. That is, the incentives in the system have become perverse. The provision of large blocks of stock options to executives has promoted them to continually increase their company stock price over the company’s long-term viability. Recently, the technique of repurchasing shares has become a way for executives to line their pockets. IBM has taken this to the extreme by buying enormous amounts of its shares. This does nothing for the company’s innovative prospects, but which quickly brings up the share prices allowing the IBM executives to cash out and promptly become wealthy (or more prosperous than they were previously). Undiscussed in the financial media, this activity is covered by progressive economist and economic historian Michael Hudson.

“Like-wise, stock market prices rise not only because pension funding and other savings are being steered into the market, but because the volume of stocks actually is shrinking. Stocks are being retired by corporate raiders in exchange for high-interest (‘junk’) bonds, and by corporations using their earnings to buy their own stocks rather than to make new direct investments. (IBM is the most notorious example here, often spending $10 billion a year on its own stock rather than on R&D or other market-building investment.)” –

Michael Hudson

If we think of Red Hat, they have historically been a high trust offering. It took decades to build up that trust and community around Red Hat. So, of course, IBM wants to extract this life force. This reminds me of the Microsoft acquisition of GitHub. Why should a company that has a history of stealing IP have the right to acquire GitHub? That code does not even belong to GitHub but to those that trusted GitHub. If unethical tech giants can kill (degrade, pick your choice of words) high trust entities like Red Hat and GitHub, this shows how entirely lacking regulation is of the IT market.

As soon as IBM makes an acquisition, our recommendation to clients is to switch out of that item as quickly as possible. Red Hat’s name, their reputation, should now be IBM’s reputation.

Note to Redhatters

Look, Red Hatters, you will be dancing with the devil in the pale moonlight if you stay. Just don’t. This is such a great time to leave. You can leave your dignity intact. You did not join Red Hat to work for Big Evil….we mean Big Blue.

Angry Comments from IBMers

We can generally count on IBM to provide highly aggressive commentary around any criticism of their company and strategy, and we received this comment from this article.

The Initial Response to the Article

“So this ‘article’ is complete garbage. They claim to know what IBM is going to do but apparently didn’t listen to anything that came out of THINK. IBM has established a clear hybrid cloud/multi-cloud strategy. IBM announced Watson Anywhere. You can run it on any cloud you want. Our product that competes with OpenShift, IBM Cloud Private just released support to run ICP on Azure, AWS, and GCS. We’ve released MultiCloud Manager, the first offering of its kind anywhere that allows operations teams to manage and control Kubernetes clusters regardless of the cloud they run on. If the author thinks Ginni has a simplistic view of the cloud, well I say, go ahead and underestimate her and a bunch of really dedicated IBMers who are determined to be the premier hybrid cloud/multi-cloud provider in the world. You may dismiss this post as nothing more than bravado, but those who know me know that I am nothing if not blunt and to the point. I don’t do bravado. You come across as former IBMers with an ax to grind and while that is your right, don’t expect others to call you on this BS.”

Our Response to the IBM Resource

“I don’t know how you concluded the article is filled with bravado. This is an analysis of the likely outcome of an acquisition. I looked up the definition of bravado and found: “a bold manner or a show of boldness intended to impress or intimidate.” Whom am I intimidating exactly? And do you have a problem with bravado in the first place? If so, IBM would seem to be a curious entity to support. I can’t speak to the “bravado scale” of the article; I want to be measured on accuracy. Moreover, the information I provide in articles is far more accurate than the information which IBM delivers to the market. You commented that I did not listen to anything coming out of THINK. This relies on the assumption that I am required to agree with things released by IBM. However, because IBM states something does not make it true. I have worked with IBM on projects and evaluated their media output, and

its accuracy is quite low

. This would be like saying I did not listen to the marketing literature around Watson. I read it, but never thought it would work, and ended up being right, while IBM was wrong.So statements do not equal truth, this is even more true with statements made by IBM and I am not required to “listen” to statements that you think I should listen to. For the comment about Ginni, which was..

“If Ginni Rometty thinks that the primary or only reason that companies use the cloud is to rent compute power to cut costs, she does not know much about the cloud.”

This quote happens to be quite accurate, and difficult to debate. Cloud services are used for much more than this. They can be used to undermine low value add and corrupt vendors like IBM. They can be used to test cloud services and components in a way that was not possible before. So yes, Ginni seems to have a very narrow view of the cloud, but IBM has yet to offer much more than hosting. So yes, Ginni has little experience running a company with cloud expertise. This is why they had to buy Red Hat, and they have nothing developed internally. Also, if you are going to contest this point, don’t do what Oracle resources do, and come up with a bunch of examples that are hosting. I am aware of IBM’s giant data center business, but cloud has a specific definition, and IBM is not doing it, even if they market hosting as “private cloud.””

And Now We Get to the Topic of Bias

“I receive the accusation of bias nearly every time I write an article that a person working for that entity disagrees with. However, no one has yet demonstrated the reason for all of this bias. I have never once been accused of a positive bias when I have written an article that casts a positive light on an entity. So why is that? If accusations of bias are legitimate and not just a smoke screen, shouldn’t I be accused of positive bias from someone within that entity?

Accusations of bias are easy to make, but what is the origin of this bias? Is it financial? Because I/Brightwork take no money from any vendor or any entity to produce research. This differentiates us from nearly all the other research entities. Curiously, companies like Accenture or Gartner have not only demonstrated financial biases, but they do not get accused of bias. I have been trying to figure out why that is. It might be because if you are a large company, fewer people are willing to accuse you of bias. Therefore, the actual level of bias is immaterial to the accusation of bias. Any small entity that contradicts a large entity can be accused of bias.

The second problem, the person claiming bias always has a clear financial bias. I used to get most of the accusations from SAP, and Oracle resources really liked my articles and felt they had no negative bias. However, then when I began to analyze Oracle, all of a sudden Oracle resources stated I had a clear bias, which did not exist when they cheered on my SAP articles. Oracle resources are so bad at this that I wrote a specific article for them on the topic of hypocrisy titled

Teaching Oracle About Hypocrisy on Lock In

. SAP resources paid by SAP. IBM pays you. How could I possibly have a higher financial bias than you? I would have to draw all of my income from some competitor to IBM, when in fact I draw none.So your financial bias is out in the open. Let us say that you hated the Red Hat strategy and you thought it would fail. Could you even write such a thing on LinkedIn without career repercussions? How much freedom of speech do you actually have? It seems IBM resources spend their time on LinkedIn promoting IBM. So not only is your bias clear, but your freedom to speak your mind is quite limited.

However, my bias is not demonstrated. I have been asking for years for someone to provide evidence of a financial bias, and no one has ever come up with anything.

Furthermore, most of my income has come from SAP. However, that does not work in terms of bias accusations, because I am probably the best-known critic of SAP. On several occasions, I have also been accused of biting the hand that fed me. But, isn’t that the opposite of bias? You are making two primary claims that lack evidence. The first is that IBM’s history should not be used to predict the future. However, history is usually the best guideline for predicting the future. The second is bias, but the person making the claim (you) seems to not recognize the problem in making such a claim without realizing their own position of bias.”

Conclusion

Claims of bias against Brightwork always come from individuals who are themselves biased. The most significant bias in society is financial bias. Yet, no individual who claims bias against Brightwork can substantiate the financial bias. When we ask for this, we observe that the article itself is an example of bias. Which is another way of saying they have no evidence? The term bias is sometimes merely a pejorative term that is used to mean preference. However, preference and bias are not the same things. Secondly, the largest and most financially biased entities in the enterprise software space are rarely accused of bias. It is an important question to ask why.

References

[1] https://r4stats.com/2012/05/09/beginning-of-the-end/

[2] https://seekingalpha.com/article/152434-is-ibms-acquisition-of-spss-too-late

[3] “After IBM bought SPSS, it steered away from the academic market, stopped the inexpensive student version bundling, went after the business market, even renaming the product PASW (Predictive Analytics SoftWare) for a while.” – https://r4stats.com/2014/08/20/r-passes-spss-in-scholarly-use-stata-growing-rapidly/

[4] https://www.bloomberg.com/news/articles/2018-10-29/why-red-hat-s-open-source-cloud-is-ibm-game-changer-quicktake

[5] https://www.prnewswire.com/news-releases/ibm-to-acquire-red-hat-completely-changing-the-cloud-landscape-and-becoming-worlds-1-hybrid-cloud-provider-300739142.html

[6] https://www.prnewswire.com/news-releases/ibm-to-acquire-red-hat-completely-changing-the-cloud-landscape-and-becoming-worlds-1-hybrid-cloud-provider-300739142.html

[7] https://www.brightworkresearch.com/softwaredecisions/honest-vendor-ratings-ibm/

https://www.sand.com/ibm-microsoft-oracle-sap-customers/

https://news.consumerreports.org/electronics/2011/12/more-signs-that-att-is-backing-out-of-t-mobile-acquisition-attempt.html